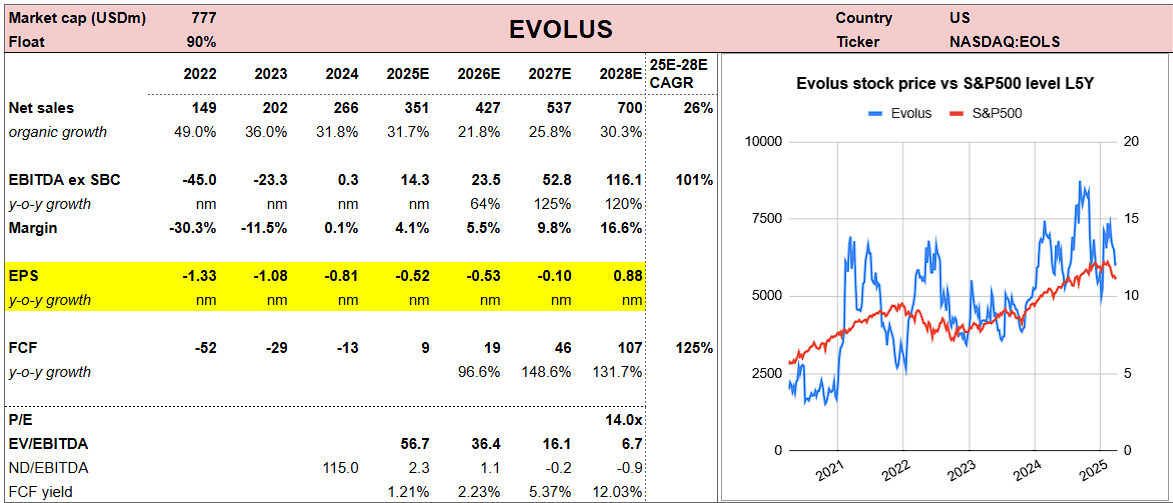

🇺🇸 🦋Evolus: Injecting Profitability

A disruptor in injectables with a visible path to +30% revenue growth p.a. and cash profitability

Avant-propos: The recent tariffs announcement is not expected to have a significant impact on Evolus, as pharmaceuticals are likely to be exempt from the new 'reciprocal tariffs'. Even in the event that they are not exempt, Evolus's robust gross margin and pricing power should provide a sufficient buffer to mitigate potential effects.

The elevator pitch: Evolus has successfully disrupted the US injectable aesthetics market by targeting younger consumers with its competitively priced product, Jeuveau, a Botox competitor. In just five years, the company has captured 13% market share, breaking a previously tight duopoly between AbbVie and Galderma. In 2025, the company is leveraging their success in toxins to launch a complementary filler line as well as entering international markets. As a result Evolus should be able to continue growing revenue around +25% p.a. and to reach cash profitability by 2026. Evolus is a high-risk/high-reward name, currently at an inflection point; if they can show sustainable profit generation the company is very attractive here. Any issues with licenses or prolonged consumer softness and the company will struggle.

Source: Elevator Pitch, yahoo finance, as of 02/04/2025

A. Market

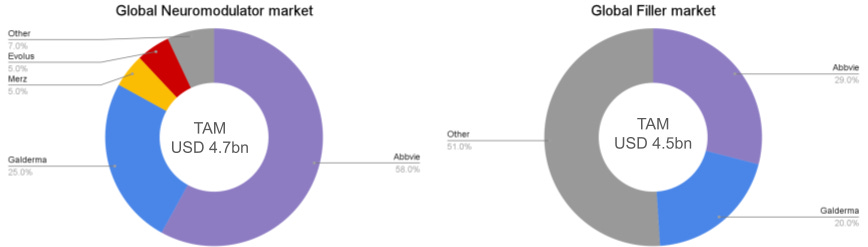

Non-surgical aesthetics procedures, or injectables, is a global c. USD 10bn market dominated by Abbvie and Galderma. Injectables, primarily refers to two product families: neuromodulators, or toxins, such as Botox, which relax muscles to smooth wrinkles, and fillers, which add volume and structure through gel injections. Those products are injected either by professional aesthetic surgeons, but more often by dermatologists in their practice or in fast growing “medical spa” in the US where customers come for a wide range of self-care routines. Although those are non-invasive procedures that do not require hospitalization and very minimal aftercare, those products can be dangerous and therefore are regulated closely. Both neuromodulators and fillers need to be approved by the FDA or equivalent local regulator before entering the market, creating high barriers to entry for new companies in the space. As a result the global market for both those products is concentrated with Abbvie dominating in both categories followed by Galderma as shown below. Currently the largest market (c. 50% of the global TAM) is in the US, followed by China (20%), and Europe being the third largest area (c. 15%).

Source: Galderma

The injectables market is growing +8-10% p.a. as those procedures become more socially acceptable in an ageing population ever more focused on appearances. If you’ve read my “What’s up with Ulta?” note, you may know that I believe beauty is one of the most attractive consumer markets to invest in thanks to the strong tailwind of an ageing population with more disposable income, less kids, and consumers being ever-more focused on their appearances, in part due to social media and high definition cameras. The below chart from a 2021 McKinsey survey shows the increase in intention to use injectables in younger generations across income brackets. What used to be procedures for wealthy elderly individuals are becoming more mainstream. Currently the most penetrated market for injectables is Korea with c. 20% of the adult population getting injections, followed by the US in the mid teens, but given the below chart, penetration could easily double over the next five years. In the US, the increase in penetration has been facilitated by the emergence and availability of medical spas which are clinics dedicated to non-invasive aesthetics surgery such as laser treatment, micro needling and injections.

Source: McKinsey

Injectable products combine the best of both worlds from pharmaceuticals and luxury beauty. Similar to medical drugs, they must undergo clinical trials and gain FDA approval (or equivalent) before being sold, creating a significant barrier to entry for new companies due to the high costs and time involved. Additionally, only medical professionals can inject them, limiting accessibility and requiring a dedicated, qualified sales force, which further restricts new entrants. However, unlike traditional drugs, injectables don't have the same limitations. They can be used by any adult who desires, as there's no specific medical indication required, and they're mostly cash-pay, so insurers and governments don't regulate pricing. With minimal side effects and no required medical indication, companies can advertise these products relatively freely. Similar to luxury skincare, the underlying cause of the issue, ageing, cannot be reversed and to keep the effects requires making recurring injections (typically every 3-6 months). This leads to loyal, recurring customers.

B. Business

Evolus disrupted the US toxin industry by targeting younger consumers with a more affordable product and borrowing the DTC marketing playbook, successfully reaching 13% market share in the US. Evolus was founded in 2012 with the goal of competing with Botox, thanks to an exclusive license with Korean pharmaceutical company Daewoong. This partnership is the foundation of their main product, Jeuveau, a neuromodulator as effective as Botox (see appendix 1) but approximately 20% cheaper. What sets Evolus apart is its go-to-market strategy. The company focuses on marketing to a younger demographic, aged 20-40, with a more affordable formulation priced at around $300 per application, compared to $400+ for competitors like Botox (Abbvie) and Dysport (Galderma). Despite regulatory restrictions on medical products, Evolus is borrowing from the Direct-to-Consumer marketing book. While Abbvie and Galderma primarily target medical professionals through their sales teams and rebate programs, Evolus is targeting the end-consumer directly through national marketing campaigns, co-branded local marketing, and direct consumer marketing(e.g. coupons). Evolus has seen significant success with this approach, with 16,000 practices currently using their app and loyalty program, which offers discounts based on usage. Historically, medical practitioners have chosen the injectable brands they offer based on their own profit margins tied to volume rebates. However, by empowering consumers to choose their formulations through gamification and financial incentives, Evolus has been able to break into the US injectables market, which was previously dominated by a duopoly. The growth of Evolus has also been supported by the rise of medical spas, which focus on self-care medical routines, including injectables, chemical peels, micro-needling, laser treatments, and general wellness treatments. There are currently more than 10,000 medical spas in the US, with half of them having opened in the last five years. Those spas did not already have loyalty to Abbvie or Galderma or any of the other products from their prescription portfolios, which made them ideal customers for Evolus.

Source: Elevator pitch, Evolus

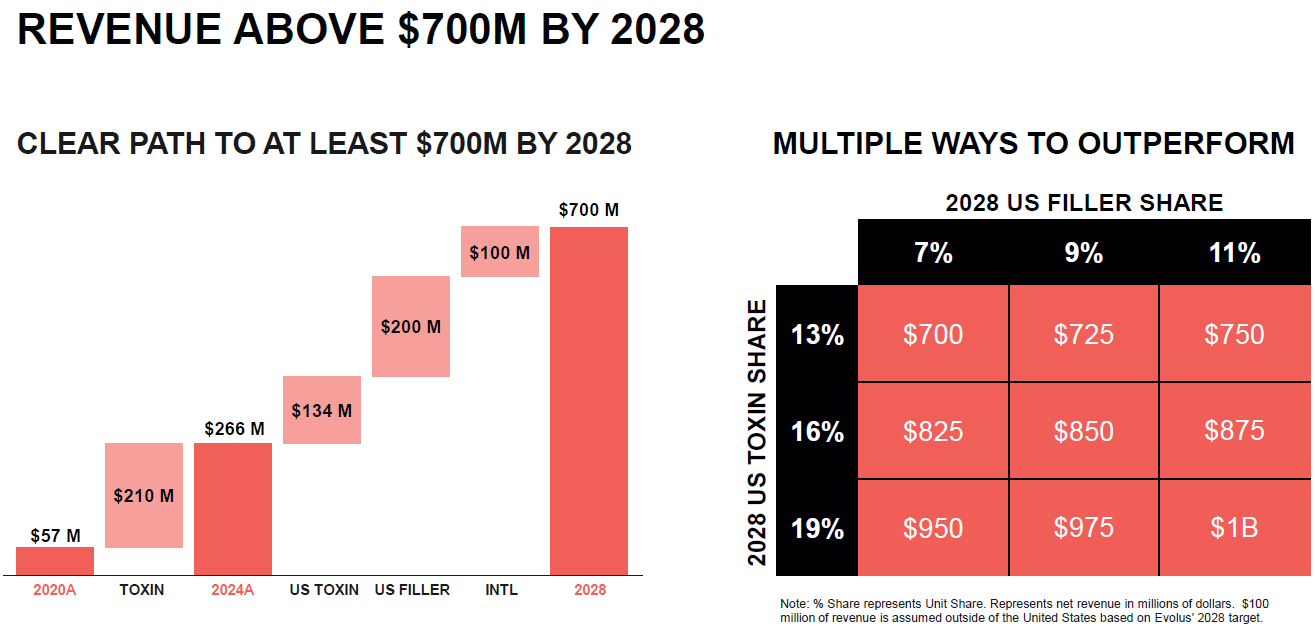

Evolus has a clear target of growing from USD 266m revenue in 2024 to at least USD 700m by 2028, equivalent to +27% CAGR, from three core initiatives:

Continue their differentiated US toxin marketing push with both medical professionals and consumers → +134m of revenue. Through their newly launched direct to consumer “Club Evolus” subscription offering (USD 49 per month for an injection every 90 days) as well as continued marketing initiatives with medical practices, Evolus can protect their market share and potentially expand it. Competition should remain rational as Abbvie is using botox as a cash cow, and Galderma is launching a new drug (nemo) and has no incentives to launch a price war. Evolus is also expanding the market which benefits them as well.

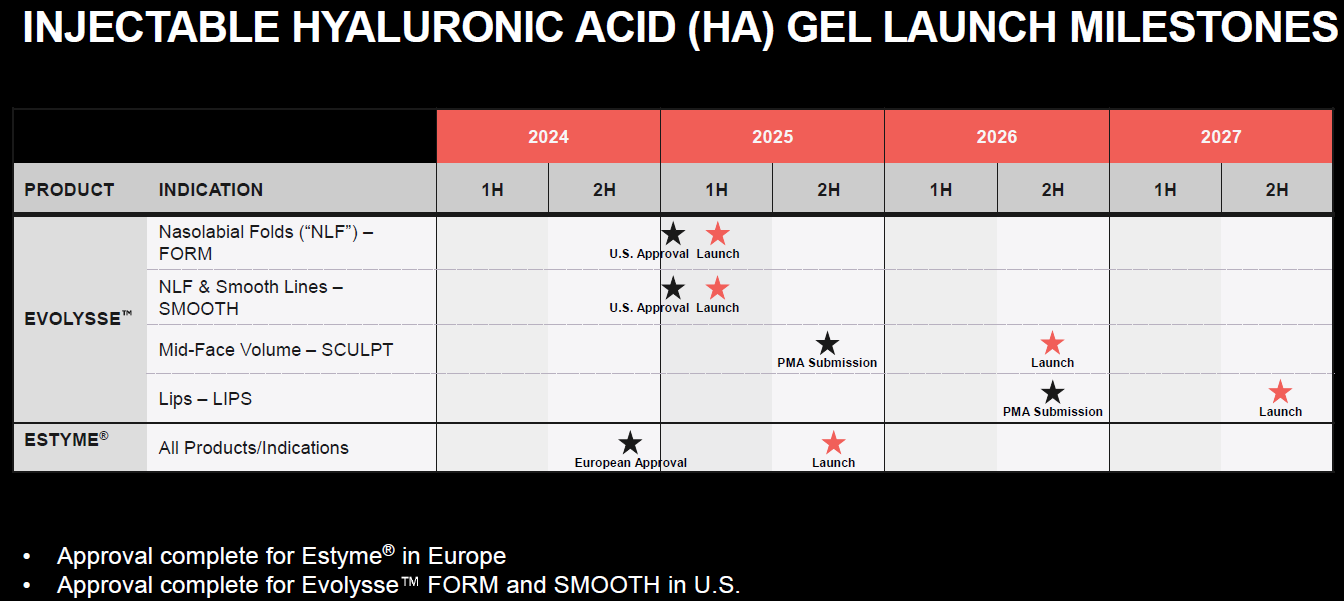

Evolus is expanding into the filler market with their new Evolysse product → +200m. Evolus has achieved significant success with Jeuveau, its competitor to Botox in the neuromodulator market. The company has now secured a filler formulation from Symatese, the company behind Galderma's latest generation of fillers, Restylane. Evolus is currently seeking approval for this new product, called Evolysse, for various uses, as each indication requires separate approval (e.g., lips and cheeks are considered two distinct indications). From a technical standpoint, Evolysse represents a notable improvement due to its cold manufacturing process, which produces more efficient filler gels (see appendix 1). This product will enable Evolus to enter the other half of the injectable market where it previously had no presence: fillers. Notably, 70% of neuromodulator users also use fillers, making it a straightforward cross-sell opportunity for Evolus. Having a filler is crucial, as many medical practices benefit from volume rebates on toxin and filler combinations from Abbvie and Galderma. Without a filler product, Evolus was at a competitive disadvantage. With Evolysse, medical practices can now offer a full range of Evolus products, and have access to competitive volume rebates. The launch of Evolysse is scheduled for the first half of 2025 in the US and the second half of 2025 in Europe.

Source: Evolus

International markets are a white space for Evolus → +100m. International was 5% of sales in 2024. Evolus has started entering Europe with Nuceiva (similar formulation as Jeuveau) in 2022 with the UK, and they have received the green light to launch their filler offering as well under the Estyme brand (as shown above). Europe is a more fragmented market but with both a toxin (Nuceiva) and a filler offering (Estyme) Evolus is well placed to compete and replicate their US success.

Evolus’s management is confident they will hit their revenue target, it is a baseline with upside optionality. Management expects a baseline revenue of $700m in 2028, assuming Jeuveau maintains its 13% US market share and grows with the industry, while also capturing 7% of the US filler market. This target seems achievable given the cross-sell advantage. However, if Evolus continues to gain US market share and Evolysse market share approaches 10%, the potential revenue could reach $1bn, representing a +40% CAGR from 2025-2028, significantly outpacing the current expected +26% CAGR based on $700m in revenue by 2028.

Source: Evolus

Although growth has been impressive, Evolus still has to show they can reach the same level of profitability as peers. Abbvie and Galderma are not fully transparent on injectables margin, but from Galderma’s reporting it seems they are making at least 30% EBITDA margin on their injectables portfolio. Despite a gross margin around 70%, in 2024 Evolus is still showing negative EBITDA as they invested to support the rapid growth of the last 7 years, including with key marketing initiatives. Evolus expects they can get to 20% adjusted EBIT margin by 2028. Margin will expand with scale as marketing has mainly been supporting national branding as well as the ramp-up of medical practitioners starting to use Jeuveau. As the marketing budget settles at a normalized percent of revenue, we should see margin expanding. The chart below shows that Evolus is at an inflection point, after many years of being negative, margin is on the verge of turning positive and is driving FCF towards positive numbers given the asset is asset light (manufacturing is fully outsourced).

Source: Elevator pitch, Evolus

C. Valuation framework

I find Evolus more attractive than Galderma given it is a pure play without the legacy divisions or an unproven new drug in the pipeline. As a L’Oréal and Nestlé shareholder I was looking forward to their former JV Galderma IPOeing in spring 2024. Galderma revenue is ⅓ injectables, ⅓ skincare (Cetaphil) and ⅓ dermatological drugs. Galderma is the global #2 in injectables with their brands Dysport/Alluzience in toxin and Restylane in fillers, and their recent liquid formulations look very impressive. My main issue with the company are the other divisions. The skincare part which is mainly Cetaphil which has been disrupted by Cerave from L’Oréal which basically own the category, Galderma would have to reinvest meaningfully to gain back market share which would hurt margin. Then their Rx drug portfolio is a collection of soon to be expired formulations, and instead of phasing it out to focus on injectables and skincare, they decided to launch a new dermatitis drug called Nemolizumab (Nemo) which is keeping the profile of the company in between pharma and consumer, making earnings harder to predict. I actually found Evolus while doing research on whether Galderma was attractive, and even though Evolus is a lot smaller and still needs to prove their profitability, I prefer a simpler business that I can wrap my head around.

Evolus is a pure play on injectables, a space with limited peers. Galderma is probably the closest peer followed by self-pay therapeutic companies such as Align, Sonova or Alcon. As a result finding the right multiple for the industry can be challenging, it does seem that currently at maturity those companies trade on a 13-17x EV/EBITDA range (see below valuation table). Assuming Evolus reaches USD 700m in revenue by 2028 and that they can reach a 11% EBITDA margin (16% ex SBC which is below their 20% target) they would have c. USD 77m of EBITDA in 2028E. By applying a 15x exit multiple on the EV/EBITDA NTM range below, returns look attractive at c. 20% p.a. As mentioned earlier this is a high risk name, and if growth fails to materialize, the downside is meaningful.

D. Risks

Despite being in existence for more than ten years, Evolus is still proving itself and is facing three key risks in my view

They don’t fully own the IP. Evolus licences their neuromodulators from Daewoong and their fillers from Symatese. Both those licenses have minimum yearly volume targets as well as specified duration. Losing the license for one of those formulations would be a going concern matter for Evolus. Based on what the company is reporting it does not seem an immediate risk, but something to keep in mind.

Increased competition: Although there are only 6 formulations for neuromodulators currently approved in the US, we could see more competition coming, especially from some of the South Korean companies. Fillers is also a more fragmented and competitive space. Gross margins are healthy but we could see some pressure if competition heats up.

Consumer softness: Beauty, although resilient, remains a discretionary category and consumers may choose to postpone their procedures or altogether not get injections in case of economic uncertainty or difficulties. Given Evolus is positioned towards the

Given the current US tariffs announced yesterday (02-April-2024), Jeuveau and Evolysse should be excluded from the tariffs given they are pharmaceuticals, but it needs to be confirmed. Evolus imports Jeuveau from South Korea, which may be subject to 25% US tariffs, and fillers from Symatese in France, potentially facing 20% EU tariffs. If not excluded from tariff, considering that the products costs in COGS account for approximately 20-30% of revenue, a 25% tariff would require a price hike of around 5-6% to offset the impact. Given its high margin and pricing power, it's likely that Evolus can pass on most of this increase to customers, although this may occur gradually over time. Competitors AbbVie (manufacturing in Ireland) and Galderma (manufacturing in Sweden) would also face similar tariffs, eliminating any potential price advantage. Until we know injectables will be excluded it does create somewhat of an overhang.

E. Management

Management is experienced and has done a good job at growing the company so far. CEO David Moatazedi was the SVP for aesthetic beauty at Allergan (botox manufacturer) and Chief Medical Officer Rui Avelar also used to be at Allergan. I believe for a company like Evolus, knowing so well the main competitor and what a successful company in the space looks like is a key success driver. CFO Sandra Beaver is also very experienced coming from Experian. Evolus’ board is reasonable in size with seven members, including the former CEO of The Cooper Companies (NASDAQ:COO).

Disclaimer: Not your financial advisor, not financial advice, do your own research, I may have positions in the names I discuss.

Find me on social media and please don’t hesitate to share feedback!

Also check the podcast on: Spotify or Apple Podcast

The Elevator Pitch — Last ten publications

F. Appendix

Appendix 1: Evolysse science

Appendix 2: Jeuveau vs Botox