The Elevator Pitch: Imagine the guilt of serving your beloved dog a meal that's more akin to cardboard than high cuisine. For many pet owners, the desire to feed their furry friends a healthier, more wholesome diet has become a moral imperative. This shift in consumer behavior has created a powerful tailwind for Freshpet, a pioneering company that's revolutionizing the $54 billion US pet food market with its premium, human-grade dog food. But what sets Freshpet apart from its competitors isn't just its high-quality products - it's the strategic control it wields over its distribution network, with 36,000 owned branded fridges in grocery stores across the country. By owning and servicing every single fridge, Freshpet has built a formidable barrier to entry, one that has allowed it to establish a quasi-monopoly in the fresh pet food space. Despite its impressive moat, Freshpet's stock has been under-performing recently, spooked by recent misses and fears the end market is slowing. However, with capacity constraints easing and margins expanding, 2025 marks a critical inflection point in the company's journey. Operating leverage is kicking in and EBITDA set to grow at a +36% CAGR through 2027, Freshpet is on the cusp of becoming free cash flow positive for the first time — yet the stock trades 45% below its recent peak. Freshpet offers a rare combination: a high-quality consumer staple business with double-digit growth potential and a distribution moat that rivals some of the best CPG.

1. Why the US pet food market is an attractive space

The US pet food market is a c. USD 54bn market growing low to mid single digits driven by several tailwinds. The "humanization of pets" has been a core driver of growth with pet parents willing to spend more for better food as they increasingly see their pet as part of the family. Forbes has a great 2024 survey on the topic highlighting how prevalent pet ownership has become in the US (66% of US households have a pet) and how important the pet is to the family (33% of dog owners live on a tighter budget to afford their dog expenses): https://www.forbes.com/advisor/pet-insurance/pet-ownership-statistics/. Another tailwind is the higher rate of pet ownership among younger generations as shown below. 86% of Gen Z have a dog versus only 50% of Baby Boomers, generating a positive tailwind as pet owners tend to remain so throughout their lives. Finally, better pet health, including through better veterinary care, is making dogs live longer, and older dogs need better nutrition to age well.

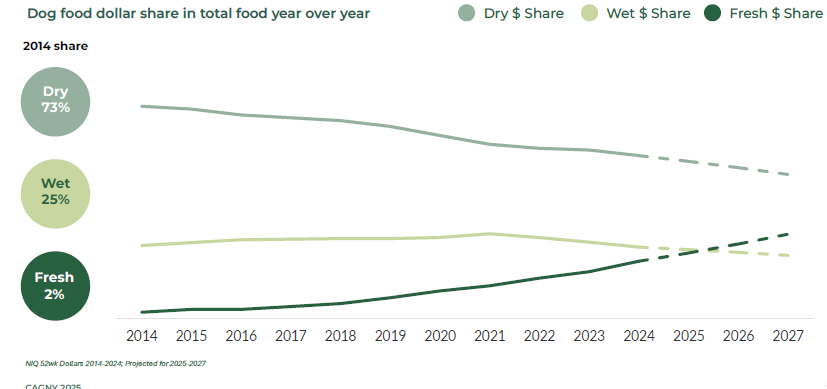

US Fresh pet food is currently small at c. USD 4-6bn TAM total addressable market) but is growing the fastest given its benefits for animals. Freshpet can be credited for creating the category in the US. Their fridges really introduced and made available fresh pet food nationally in grocery stores, supported by successful ad campaigns. Fresh pet food went from 2% of the pet food market in 2014 to about 4-6% today, taking market share on wet and dry as shown below. Freshpet believes that we could see fresh becoming larger than wet this year. For customers, the key benefit is a visible improvement in their pets' health and general happiness. Nutrition is essential for an animal's health and lifespan. Freshpet products can significantly enhance well-being, with 72% of pet parents reporting higher energy levels, 68% experiencing fewer digestive issues, and 66% noting better breath after switching to Freshpet (source: Freshpet Visible Difference Study). It is worth noting that changing a dog diet is a usually several weeks ordeal and can bring some digestive issues, once converted to the brand, customers tend to not want to change the dog's diet creating customer stickiness.

The US pet food market is an oligopoly dominated by Nestlé and Mars, but they have little interest to compete in fresh. The U.S. pet food market is a concentrated oligopoly, with Nestlé and Mars controlling over 50% of the market share combined. Including major players like Colgate-Palmolive (Hill's Nutrition), General Mills (Blue Buffalo), and JM Smucker, their combined share rises to 75%. The US pet food market is a well-behaved oligopoly (i.e. limited price competition) for what is, in most of those companies, one of their highest margin division. In the fresh pet food segment, Freshpet dominates with a staggering 96% market share, according to Nielsen data. This is largely due to the lack of meaningful competition, as other companies have struggled to crack the fresh pet food market. Other major brands have struggled to enter this market, with attempts from Nestlé (Purina's "Fresh Start" in 2012), Frito-Lay in 2013, and General Mills (Whiskas Fresh in 2015) all falling short. The challenges of manufacturing, delivering, and storing fresh pet food—often more complex and lower-margin than shelf-stable products—have deterred these companies. Freshpet's decade-long effort to establish a reliable supply chain is a testament to these difficulties. However, Colgate-Palmolive's recent acquisition of Primo100, an Australian fresh pet food business with estimated revenues of $100 million, may signal a renewed interest in the space, warranting close monitoring.

Frozen DTC brands are competing but struggle to be profitable. Farmer's Dog is often cited as a competitor to Freshpet, offering a direct-to-consumer (DTC) online subscription that delivers customized pet food menus to customers' doors. As a private company, Farmer's Dog's revenue estimates are not available, although some reports suggest it may be nearing $1 billion in sales. However, despite its potential scale, it is unlikely that Farmer's Dog is currently profitable. A key challenge for the company is the high cost of shipping frozen food, which requires specialized packaging and trucks to maintain the correct temperature. A chicken pack for a medium-sized dog would be approximately 20% more expensive through Farmer's Dog than through Freshpet. More expensive for customers and not profitable to run is not a sustainable formula and that competition should lessen over time.

2. Freshpet is a unique vertically integrated pet food company with a deep moat in distribution

Freshpet is the leader in US premium fresh dog food, a resilient category. With almost USD 1bn of revenue in 2024, New-Jersey headquartered Freshpet is the leader in fresh pet food in the US, mainly targeting medium size dogs (11-25lbs dogs are c.45% of Freshpet current customers). Freshpet is renowned for its high quality products with several SKUs being FDA "human grade" quality. Their marketing moto is "it's not dog food, it's food food". The core Freshpet product was initially a meat roll but the company has since then expanded into full fresh meals as well as snacks. The company is focusing on traditional channel given the constraints of distributing refrigerated products. They are present in the US across most large grocers such as Walmart (about 20% of revenue) and Kroger and in specialty pet stores. Online sales/DTC are not a priority given the difficulty to make them profitable but Freshpet is experimenting with their own DTC as well as through a partnership with Petco.

A unique network of 36,000 fridges differentiates Freshpet and creates a unique moat. Many companies have attempted to enter the pet food market, which is dominated by a few large manufacturers, as discussed in Section 1. What sets Freshpet apart is its successful placement of branded fridges in stores, starting with pet specialty shops and expanding to mass retailers like Walmart. Traditionally, retailers have been reluctant to allow branded fridges due to space constraints, optimized shelving concerns, and the absence of slotting fees (fees charged to brands for prime shelf placement). However, once Freshpet proved that its products generated high demand and margins for retailers while driving customer traffic, it created a virtuous flywheel for the brand. From a logistics perspective, Freshpet owns, maintains, and refills the fridges, which exclusively carry Freshpet products. This arrangement not only serves as significant in-store marketing (see below) but also establishes a strong competitive advantage, as grocers are hesitant to add more fridges for new brands in this niche, further protecting Freshpet's position. Each fridge costs approximately $4,000, with an average payback period of just six months.

Freshpet is mainly exposed to resilient high-income consumers with low price elasticity. Freshpet products are priced at a premium compared to traditional dry food, with a typical meat roll costing $3.55 per pound. Incorporating Freshpet into a dog's diet can cost more than twice that of a standard entry level Pedigree diet. Consequently, 90% of Freshpet's customer households earn over $80,000 annually, with penetration exceeding 30% in dog-owning households earning more than $125,000 per year. These families tend to be less price-sensitive and prioritize their pets' well-being over other expenses. Over the years, Freshpet has consistently increased its household penetration, currently reaching 14 million households, equivalent to c. 21% of dog owning households, reflecting an +18% CAGR since 2019. Within this customer base, Freshpet specifically targets HIPPOHs (high profit pet owning households) and MVPs (most valuable pet parents), who account for 90% and 69% of revenue, respectively, due to their high buying frequency and volume.

Freshpet is vertically integrated making them asset-heavy but generating more operating leverage. As part of its commitment to quality, Freshpet chose to avoid co-manufacturing, a choice that created significant challenges during its growth. One notable example was the several periods of being sold-out during the COVID-19 pandemic, which resulted from insufficient ramp-up capacity in face of the heightened demand. To address this issue, the company has increased its capital expenditures since 2020 to expand its Pennsylvania facility and establish a new one in Texas. Between 2014 and 2024, Freshpet invested over $1 billion in capacity expansion, with plans to allocate an additional $500-750 million by 2027. This strategic investment aims to secure a revenue capacity of at least $2-3 billion, effectively tripling the company's current levels. The following is an overview of Freshpet's supply chain, which is primarily owned by the company, except for some last-mile distribution:

3. Freshpet has a simple but powerful growth algorithm

Freshpet has a simple business model with a straightforward revenue build-up, we go through the three main revenue drivers below

A. Freshpet is focusing on increasing its household penetration level. Out of the 65 million households in the U.S. that own dogs, Freshpet has identified its core addressable market at c. 33m households. The company aims to reach a total of 20 million households by 2027, representing a growth rate of over 14% per annum over the next three years. In comparison, Blue Buffalo, General Mills' premium offering, currently serves 31 million households in the U.S. Freshpet's penetration drivers are threefold: (i) the ongoing humanization of pets, which fuels premiumization; (ii) an increased marketing budget to enhance brand awareness; and (iii) expanded distribution. With around 30,000 distribution points, Freshpet currently covers only about 75% of the grocery channel in the U.S., compared to 91% for Purina and 84% for Blue Buffalo. Additionally, the company is targeting online sales through partnerships with Petco and its own direct-to-consumer (DTC) offerings, which can attract customers who live too far from a store with a fridge. Finally, there is a significant opportunity for Freshpet to focus on larger dogs, which represent a disproportionate share of the market due to their higher daily intake.

B. Increasing the frequency at which customers are choosing Freshpet. Approximately 60% of Freshpet customers currently use the products as occasional treats or for special occasions, driven by their high quality and the fact that dogs love them. However, Freshpet aims to increase customer loyalty by encouraging these occasional users to incorporate more Freshpet meals into their dogs' regular diets. To achieve this, the company has expanded its product offerings, see below for the full range of brands, utilizing its additional capacity to launch new brands such as Nature's Fresh, which emphasizes responsible food choices. Additionally, Freshpet's subscription service plays a key role in this initiative, as it delivers tailored meals directly to customers' homes, promoting a higher frequency of use compared to traditional impulse purchases made during grocery shopping.

source: Freshpet

C. Buy rate is a combination of product mix and pricing power. The buy rate is influenced by several factors, including the size of dogs (larger dogs require more food), the mix of products purchased, and overall pricing strategies. Historically, Freshpet has focused on volume growth by expanding its fridge placements in new locations. During the COVID-19 pandemic, the company successfully implemented price increases of over 27% to offset inflation, while only experiencing a modest 6% decline in volume. This demonstrates a relatively low price elasticity. As Freshpet continues to refine its product offerings and enhance customer loyalty, it will gain the flexibility to leverage pricing strategies further, allowing for potential revenue growth without sacrificing volume.

In addition to its organic growth strategy in the U.S., Freshpet is exploring two potential avenues for expansion that are not currently in the company's targets:

International Expansion: While currently small (c.2% of revenue), international markets could become a significant growth engine. Freshpet has a small presence in the UK and Canada, which has validated demand for its products. The company is actively seeking a manufacturing partner in Europe, as shipping from the U.S. is not economical and not ideal for product preservation.

Other Animals: While dogs represent the largest segment of the pet food market and are particularly sensitive to food quality, making them ideal candidates for fresh offerings, there is also significant potential to expand into fresh food for other animals. One notable opportunity is the cat market, which currently accounts for only 1% of Freshpet's revenue. With approximately 46 million households owning cats, this segment could provide a substantial additional leg of growth for the company.

4. Freshpet has a history of fast growth and is on the cusp on being profitable and FCF positive

Freshpet has been growing revenue uninterrupted at +27% CAGR 2011-2024, and their trajectory to reach USD 1.8bn revenue in 2027 seems reasonable. An important driver of Freshpet's growth over the past decade has been the tripling of its fridge locations to approximately 30,000 stores by 2024. This expansion has significantly supported volume growth by giving access to new households, resulting in an increase in household penetration to 14 million by 2024. Reaching 20m households in 2027 would already guarantee more than half of the targeted growth, with the balance having to come from frequency and buy rate which given the current trend and new product launches seem realistic.

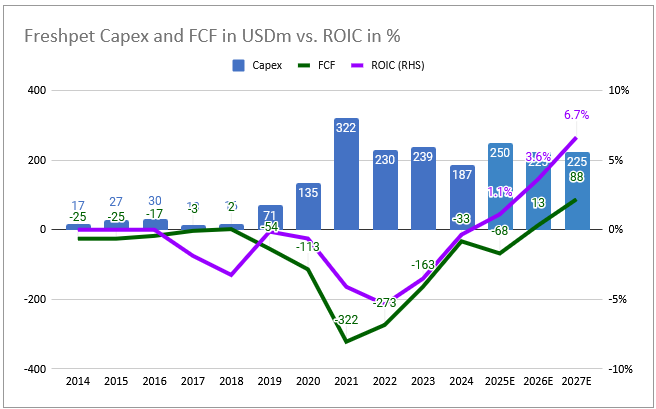

During covid, Freshpet has struggled to keep up with demand, but capacity issues should now be solved and FCF should turn positive. During Covid, revenue growth accelerated more than doubling between 2019 and 2022. Given the vertically integrated setup, the company struggled to face demand which was compounded by covid related supply chain issues and high cost inflation pressure, which meaningfully degraded gross margin and derailed the FCF as shown below. Freshpet has invested in excess of USD 1bn over the last three years into their capacity and they will invest another USD 200-250m p.a. at least over the next three years. As the company is now equipped to face up to USD 3bn of revenue, gross margin should normalize back to the mid to high 40s and I expect FCF to turn positive next year.

22% EBITDA margin seems achievable given the operating leverage kicking in. Below the gross margin, Freshpet allocates approximately 10% for marketing, 7.5% for logistics, and 9% for other general and administrative expenses, including stock-based compensation. While marketing expenses are likely to grow in line with revenue due to their critical role in reaching new households, the other costs should begin to decrease as a percentage of revenue, facilitating margin expansion. Freshpet has recently revised its 2027 EBITDA margin target from 20% to 22%, and given the company's strong operational performance to date, further upgrades to guidance may be on the horizon.

Given Freshpet's current stage of development, ROIC is not the right metric. However, I expect to see ROIC turn positive from this year onwards, as the benefits of recent investments begin to materialize. Freshpet has not made any significant acquisitions, and management has not indicated any plans for acquisitions at present. Additionally, the company is nearing the end of its capex cycle, which should lead to improved returns on investment as the new capacity comes online and begins to generate revenue, ultimately driving increased revenue and profitability as the company scales up its operations and improves asset utilization and efficiency.

5. Governance and capital allocation

Management are excellent operators and dog lovers. I had the opportunity to meet both Billy Cyr, the CEO, and Todd Cunfer, the CFO, in 2023, during a challenging period marked by supply chain and financing issues. I was impressed by their deep knowledge of consumer packaged goods (CPG) and retail distribution, as well as their genuine passion for the business. Notably, Billy's dog, Appa—named after the flying bison from "Avatar: The Last Airbender"—is an integral part of the team, participating in product testing and marketing efforts. Among the original founders, only Scott Morris remains as an executive, although he is not on the board. While I find the board somewhat large for my taste, with 12 members, it is primarily composed of highly experienced CPG and retail executives, which adds valuable expertise to the company.

So far Freshpet has been a pure organic growth story and all of the cash has been used for building up capacity. Freshpet management has been very focused on building their own capacity and scaling up the business and existing brands. Based on recent management communication it does not seem large M&A is on the horizon. I would also not expect the company to do any returns to shareholder. Any cash will go down to paying the debt and/or repaying the convertible. ND/EBITDA of 0.77x in 2024 is very reasonable and leave financing capacity for further expansion or potential M&A.

6. Valuation seems relatively reasonable but it is a volatile stock

Although Freshpet is a company with almost 20 years of existence it is still early in its lifecycle. Freshpet is just now reaching the USD 1bn of revenue mark after building up capacity over the last 10 years. It still has plenty of growth left supported by the many tailwind of the fresh pet food industry. From a multiple perspective the company trades at 22.1x EV/EBITDA 2025E in line with a Colgate (22.9x) at despite a much faster growth rate in the coming years or a Nestlé at 20x despite Nestlé being in the middle of a turnaround. In the below table I have also added two asset-heavy fast-casual names which share some growth similarities with Freshpet, compared to Chipotle and CAVA Freshpet looks attractive on a EV/EBITDA basis for the growth it can deliver.

From a DCF perspective, the stock is attractive here. Once scaled fully in 2027 and with high capacity utilization, Freshpet has the potential for high free cash flow generation. On a reasonable projection assuming management reach their 2027 targets and then applying a deceleration of the growth rate towards a 2.5% terminal growth rate and EBIT margin expansion up to 24% would imply a 35% upside to the current stock valuation or 26% ex the maximum dilution of the convertible (see Appendix 1)

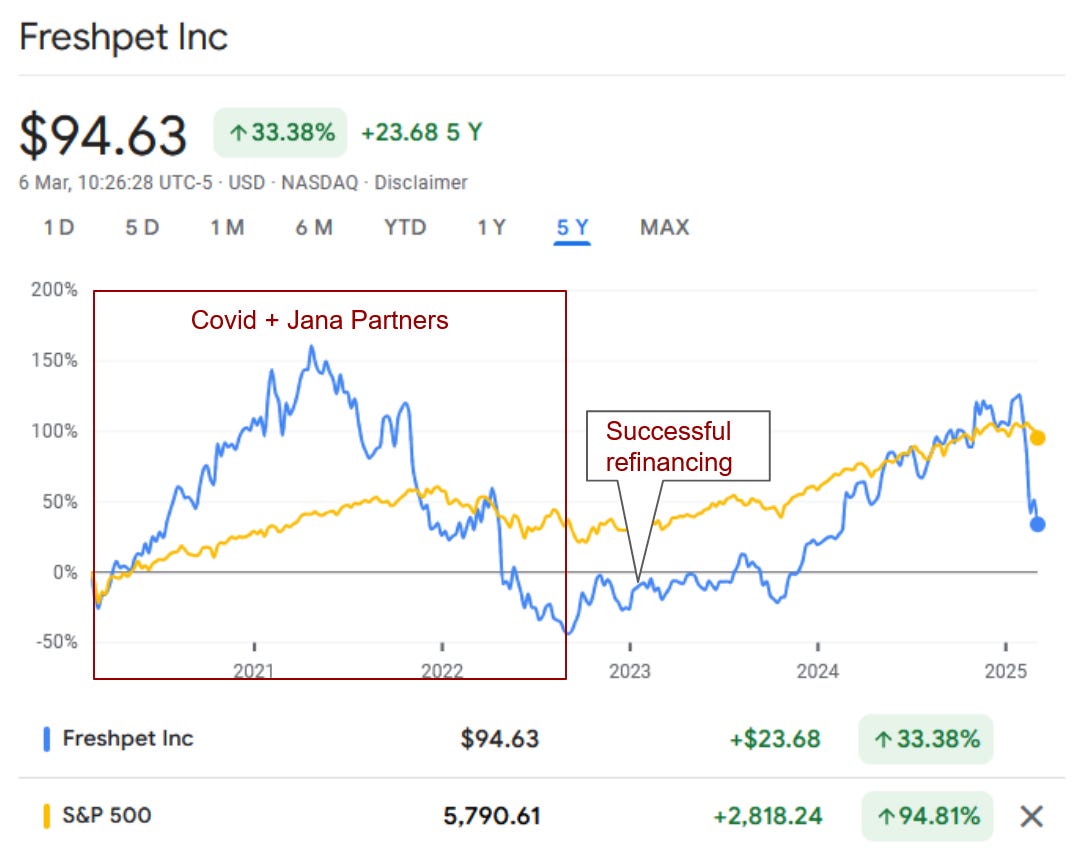

Freshpet has a volatile trading history. In 2022 Jana Partners tried to get a board seat to force a sale to one of the large CPG company. The move was resisted by the board and management who managed to refinance through a convertible and keep the company independent however the headlines generated quite a bit of volatility in the name. More recently the Company slightly missed expectations for Q4 sending the stock down almost 20% on the day on fear of a deceleration of the end market. Since then the stock has continued to contract and is now 45% below its peak from end of January.

7. Risks

The key risks for Freshpet are:

A softening consumer environment. Although resilient, Freshpet growth targets require a relatively robust consumer. It is probably not the stock to own in case of a recession

Increased competition: Colgate acquisition of Primo100 could be a signal that big CPG are starting to look again at the category. Although the fastest way for any of them to succeed in this space would be to acquire Freshpet

Loss of management/Key man risk: I do believe Billy and Todd are extremely skilled and needed to execute on the ambitious 2027 targets.

Quality scandal: Although limited by the vertical integration, a food scandal around one of Freshpet's products could meaningfully damage the company's reputation and hurt sales.

I am always looking for feedback on how to improve and whether my writing is useful. Don’t hesitate to reach out of leave a comment to let me know what you think!

Appendix 1: Convertible

Appendix 2: Corporate History

Freshpet was founded in 2006 by Scott Morris, Cathal Walsh, and John Phelps with the vision of bringing fresh, preservative-free pet food to grocery stores. The company pioneered the concept of branded refrigerated fridges in retail locations, offering human-grade pet food at scale—an operationally complex model that remains unmatched by competitors. Morris, who spent over a decade at Ralston Purina and The Meow Mix Company, initially served as Freshpet's Chief Marketing Officer and later became its President and COO, a role he continues to hold today. Walsh, bringing marketing expertise from Nestlé Pet Care, now leads Freshpet's European operations, while Phelps played a crucial role in the company's early development but is no longer publicly active in the business. By 2014, Freshpet went public on NASDAQ, raising approximately $156 million in its IPO and solidifying its position as a category creator in the pet food industry.

Disclaimer: Not investment advice, I may have positions in the securities I discuss. Do your own research before investing.