Global-E (GLBE) is a B2B company simplifying cross-border e-commerce for direct-to-consumer (DTC) merchants. They provide a one-stop-shop integrated within most e-commerce tech platforms, such as Shopify, that allows merchants to leverage GLBE's ability to reach 200 countries across various locally relevant payment and logistics partners while abiding by local regulations.

The Company benefits from tailwinds in cross-border DTC e-commerce and has little competition. The globalization of tastes, social media, and ease of doing economically attractive DTC generate secular tailwinds for cross-border e-commerce. #2 by gross merchandise value (GMV), GLBE has gained market share by leveraging its partnership with DHL and Shopify. GLBE's moat is built upon its global reach and market-leading one-stop-shop capabilities. GLBE estimates their GMV TAM is USD 250bn.

The Company is still led by the ambitious founders and currently net cash. The three Israeli founders are still at the helm and relatively young (below 50) with ambitious plans for the company. GLBE has been FCF-positive since 2019 and currently has c. USD 300mn of net cash, which gives the company flexibility for internal development and bolt-ons to acquire technology and further consolidate the space.

The biggest risks to GLBE are an economic slowdown, tariffs, and the Shopify agreement. GLBE takes a 6-8% take rate of its merchants' GMV, making it sensitive to an economic slowdown. Tariffs may also impact the relative attractiveness of imported goods. Finally, the Shopify agreement has a lot of growth potential but creates some dependencies on Shopify. An escalation of the conflict in the Middle East would also be a risk, given that half of the employees are in Tel Aviv.

Cross-border e-commerce benefits from secular tailwinds and should continue to grow 10%+ p.a. Globalization of consumer tastes drives cross-border demand for items unavailable domestically. In parallel and benefiting from those trends, we see more small and medium size companies launching successful products and taking market share from large incumbents. This phenomenon is reinforced by social media influencers that create virality and expand the reach of popular items. Currently, cross-border e-commerce ex. China is estimated to be c. USD 630bn, up 33% CAGR since 2018 and currently representing c. 15% penetration of total e-commerce globally. Driven by the above trends, expectations are for penetration to expand, driving cross-border e-commerce growth of 20% CAGR by 2027. GLBE believes they can address about USD 200-300bn of that market, as they do not target large merchants that can handle cross-border by themselves.

CROSS-BORDER E-COMMERCE TAM (INCLUDING CHINA)

Source: International Trade Administration, eMarketer, McKinsey

GLBE's core market, Direct-to-consumer (DTC) e-commerce, continues to grow faster than the category. In the US, DTC e-commerce has grown 25% p.a. 2018-2023, reaching USD 210bn of GMV, boosted by COVID-19, but still on an upward trend past 2021. Given better economics for merchants than 1P retailers and marketplaces combined with technological advances (including the advent of platforms such as Shopify and Wix) and social media marketing, DTC is expected to grow faster than the global e-commerce market. Younger generations are also more informed about products and are more attached to specific brands, often discovered through social media, driving higher preference to shop directly from brands' websites, as shown below.

CROSS-BORDER CHANNEL PREFERENCE BY AGE GROUP

Source: Censuswide Market Research Consultancy, 2022

GLBE is the second largest enabler of DTC cross-border e-commerce globally. Created in Israel in 2013 by three co-founders, GLBE has become a leader in its segment with a GMV of c. USD 4.5bn in 2024E. The Company cut the complexity of selling abroad for merchants by handling all the processes in exchange for a c.6-8% net fee on GMV. For the merchant and the end consumer, the solution is transparent. Merchants benefit from selling to as many as 200 countries with no upfront investments or ongoing fixed costs. End consumers benefit from a simplified and localized shopping experience that drives more purchase conversion. GLBE is platform agnostic and can be used as a standalone product with its own front-end, or it can integrate directly with the most popular platforms such as Shopify, BigCommerce, SAP, Salesforce, Magento, or Wix.

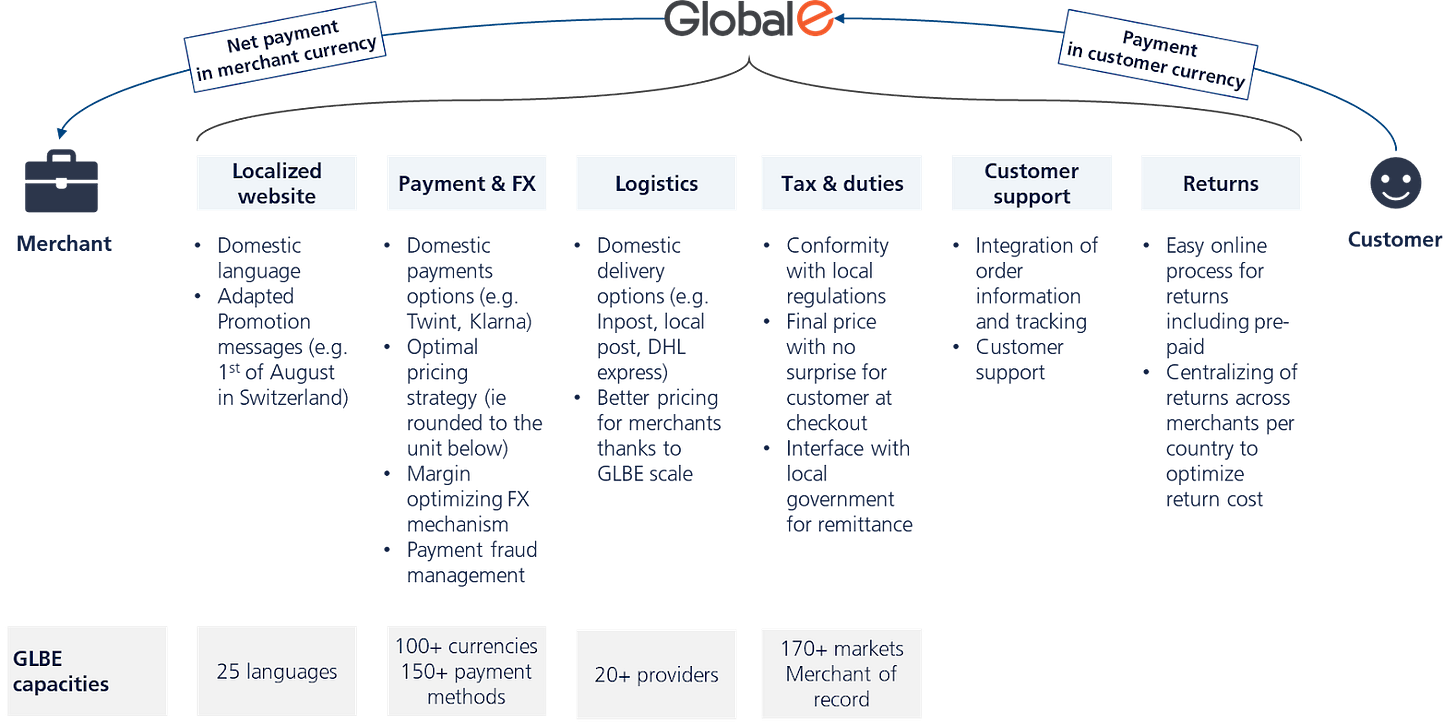

GLBE's moat stems from the complexity of the cross-border process and the scale and reach they have established over time. GLBE is a one-stop solution for merchants; the Company takes over the many steps needed from localized checkout, price setting and FX, duties and regulations, fulfillment and logistics, local customer support, and handling returns. GLBE also shields the domestic merchant from potentially costly mistakes (e.g., unintentionally breaking the law on the export of products, GDPR, or failure to pay duties) by being the legal merchant of record. GLBE's platform is regularly mentioned as the easiest to onboard and use, and many expert calls mention the unmatched breadth of providers offered across countries, payment options, and logistics, as well as the deep knowledge of markets allowing the GLBE sales team to provide successful advice on go-to-market.

GLBE GLOBAL OFFERING

Source: Company reports

Competition is mainly from in-house operations and a limited set of peers. Large companies with enough volume in a country often set up their own operations through subsidiaries or local distributors. However, even big brands like LVMH, BOSS, and Adidas use services from GLBE for countries with lower volumes. GLBE's main competitor is ESW, a French and Swiss post joint venture, headquartered in Dublin, generating EUR 1.2bn in revenue. Despite being larger, ESW relies heavily on Nike (more than 60% of GMV, according to experts) and focuses on very large enterprises with deep custom integration. GLBE stands out with its one-stop-shop approach, while other firms like FedEx International Connect, Digital River, Riskified, and Reach offer only partial services. In 2022, GLBE expanded by acquiring Borderfree and Flow, adding both technological know-how and acquiring merchants.

CROSS-BORDER OPTIONS FOR DTC MERCHANTS

GLBE has a diversified base of customers with a focus on luxury brands. GLBE works with 1,256+ merchants. No single customer represents more than 10% of the company revenue. The average GMV per merchant is c. USD 2.6m in 2023. The company also has some larger enterprise merchants, including the recent win of Victoria's Secret, Hugo Boss, Disney, Adidas, Michael Kors, Rimowa and Crocs. About 40% of the current merchant base is within the luxury sector, with the rest diversified across other consumer categories (footwear, cosmetics, accessories, children’s fashion, watches and jewelry, sporting equipment, toys and hobbies, automotive spare parts, and others).

A DHL partnership has allowed GLBE to achieve better pricing than peers against exclusivity for express shipping. In 2017, GLBE formed an exclusive partnership with Deutsche Post (DHL GR), positioning DHL as the sole provider of express delivery services. For non-express deliveries and locations where DHL express is not available, GLBE can choose any provider they prefer. This agreement allows GLBE to offer better pricing to their customers, making them more appealing to merchants. In 2021, DHL acquired a 12% minority stake in GLBE, which they have maintained. Additionally, DHL facilitates lead generation for GLBE by promoting the service to their customers.

The 2023 Shopify partnership should continue to support growth rate acceleration. Shopify has become the dominant platform for DTC, with almost 30% global market share in 2023. In 2023, GLBE became the exclusive provider of cross-border solutions for Shopify within a white-label product called "Shopify Managed Markets" for US merchants; in return, Shopify was granted warrants, giving them 13% ownership of Global-E. Managed Markets is aimed at small and medium businesses wanting to explore cross-border. The addressable Shopify GMV is around c. 15bn. GLBE expects c. USD 200m GMV contribution in 2024E (c.5% of total GLBE GMV). The managed market flow will be a lower take-rate for GLBE as they share the economics with Shopify but lower cost as it is a pure integrated solution with no merchant support. It should not be margin-dilutive but has the potential for high GMV growth accretion.

GLBE has plenty of white space outside of its current markets and verticals. GLBE has mainly grown through merchants in the US sending products to Europe and vice versa, which drove the US and Europe to represent 50% and 46% of revenue, respectively, in 2023. The Company is expanding globally by adding merchants in new geographies, such as Seiko in Japan. 75% of disclosed new merchants since 2023 are from outside the US. The Shopify partnership may keep the US weight constant or increasing in the near term.

NEW MERCHANTS ADDED BY REGION BETWEEN JANUARY 2023 and JUNE 2024

Note: France's overweight is linked to the luxury vertical overweight.

Source: based on disclosed names since 2023

The GLBE founders are still at the helm and very ambitious. CEO Amir Schlachet (47 years old), COO Shahar Tamari (52), and President Nir Debbi (50) met while working at Bank Hapoalim in Israel before launching GLBE in 2013. Before going public on the NASDAQ in 2021, the Company secured funding from Israel-based Red Dot Capital, Vitruvium Capital, Apax Partners, and DHL. The founders have a strong track record, having primarily grown the business organically and established partnerships with DHL and Shopify. Collectively, they still hold 10.3% of the Company and demonstrate a strong commitment to its success, as indicated in interviews and earnings calls.

I expect revenue growth of +27% CAGR 2024E-2030E, leading to +35% EBITDA CAGR. Top-line growth is made of c. +14% p.a. SSS from existing merchants benefitting from cross-border e-commerce trends, the ramp-up of new merchants, and +13% net growth in merchants. I expect R&D to decrease to 10% of sales thanks to operating leverage and SG&A to grow at half the sales growth. Given the capital-light aspect of the business it drives adjusted EBITDA growth of +35% p.a. 2024E-2030E. As the Company is net cash, the only below-the-line items will be net interest income, taxes from 2025 (at 25%), and the impact of SBC on share count (c. +1% p.a.). As a result, I expect to see EPS growth of 55% 2024E-2030E. More importantly, given the asset-light business model (basically no capex), I expect FCF conversion of c.60% p.a., driving USD 1.9bn of FCF 2024E-2030E and with cash accumulating on the balance sheet, net cash of c. USD 1.2bn by 2030.

Capital allocation has been reasonable so far. The Company turned FCF positive in 2019, and it has used the cash and shares to acquire two bolt-ons (Borderfree for USD 100m and Flow for USD 500m) to add to its technology stack and acquire merchants. As of the end of 2023, the Company has a net cash position of USD 294m or c.5% of the market cap. The Company does not plan on large M&A but may continue consolidating competitors or enhancing its technological capabilities through smaller add-on acquisitions. Additionally, GLBE's management aims to maintain their ability to invest in the business. Returns to shareholders are not a current priority.

The main risks for GLBE are a global economic slowdown, war in Israel, tariffs, and the Shopify relationship. GLBE relies on cross-border e-commerce volume for revenue. Most of their customers' products are discretionary, so reduced consumer spending would affect sales. Tariffs on foreign goods could also reduce demand by making imports pricier. However, it might increase business for GLBE as companies facing greater complexity with in-house cross-border trade may choose to outsource. GLBE's partnership with Shopify is a significant growth opportunity, but if Shopify changes providers or terms, it might impact revenue. However, this risk seems unlikely due to Shopify's heavy integration with GLBE and their 13% ownership; their agreement renews in April 2025. GLBE headquarters are in Tel Aviv, where about half of the company's 1,000 employees and the founders are located. If the current conflict were to expand and reservists were called or attacks targeted Tel Aviv, there could be severe distribution to GLBE's ability to service their customers.

GLBE's valuation is reasonable, given its growth prospects. We have limited historical data, given GLBE's recent IPO in 2021 and given the uniqueness of their business, there is no close peer with whom to compare GLBE. As a result, I find it most useful to compare it to other "complexity simplifiers" and vertical software companies in e-commerce and financials. Given the EBITDA growth I expect in the mid-thirties, it seems a reasonable valuation, especially compared to Shopify.

EV/EBITDA VS N3Y EBITDA GROWTH