Grindr - Designed to Never Be Deleted

Grindr's Untapped Potential: Inside the Turnaround of the Iconic Gay Dating App

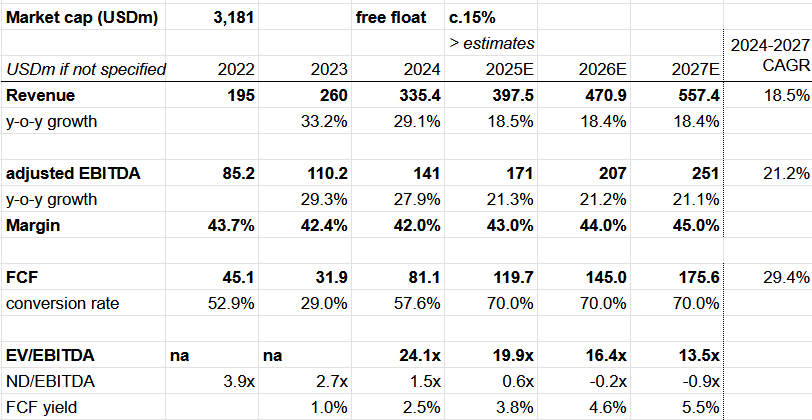

The elevator pitch: Grindr is the dominant gay casual dating app, boasting 15 million monthly users and targeting a global market of around 400 million gay men. The company benefits from strong network effects and a wealthier-than-average customer base that engages with the app about 1 hour per day in average. Unlike straight dating apps where the goal is often to delete the app after finding a partner, Grindr users rarely churn out, leading to high user retention and sticky subscription revenue. Grindr's unique position has been under-monetized for years, largely due to ownership instability and technical debt. Since its 2022 SPAC IPO, new CEO George Arison has been turning the business around — hiking subscription prices, launching new features, and pushing into international markets. ➡️I expect Grindr to deliver double-digit top-line growth while maintaining a low-to-mid 40s EBITDA margin that enables significant free cash flow generation. The current EV/EBITDA multiple of 19.9x for 2025E appears reasonable given the company's ability to grow EBITDA by over 20% p.a. in the next three years and its limited debt levels, with a net debt to EBITDA ratio of 1.4x in 2024E.

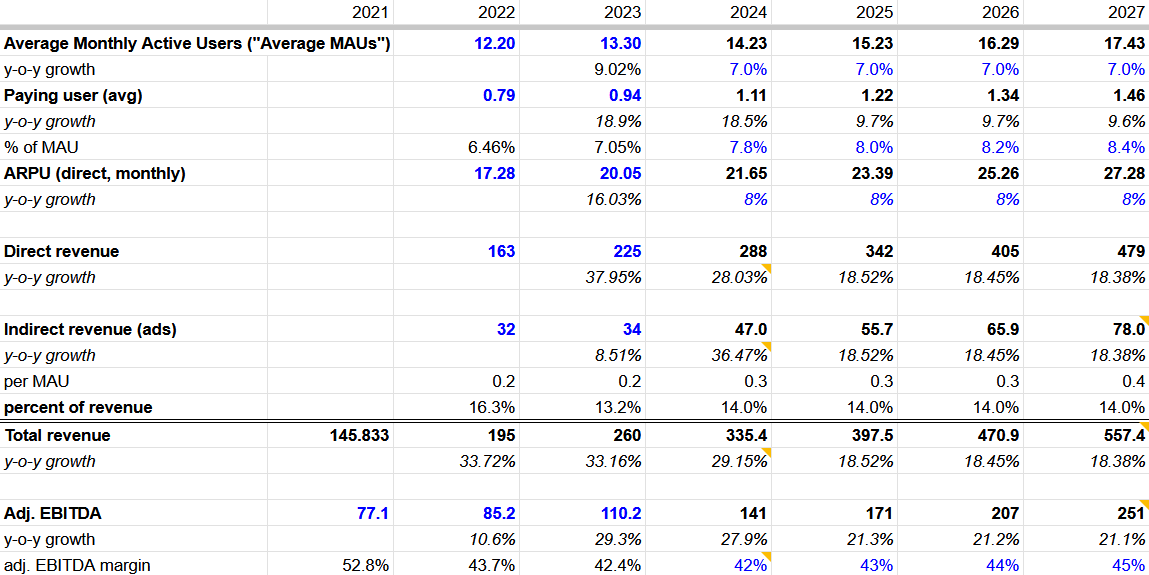

Financials and estimates

source: Grindr, Elevator Pitch

(📖Reading time less than 10 minutes)

Nota Bene: In this report, I will use the term "gay" as an umbrella term to encompass all sexual orientations, including bisexuals, pansexuals, and others who use Grindr. This approach aims to simplify the reading experience.

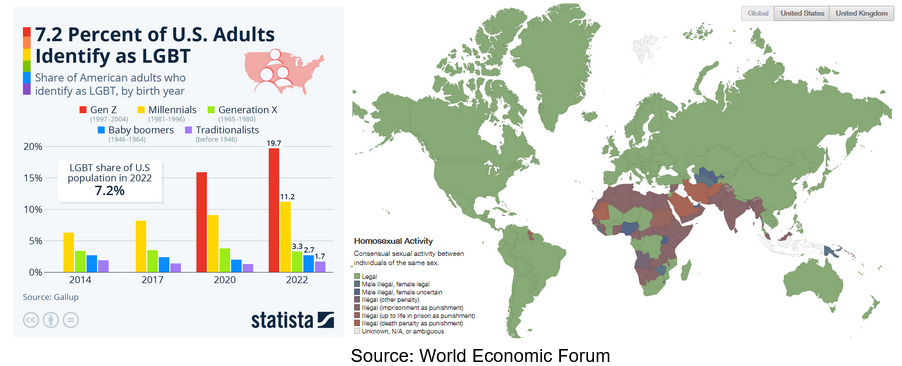

Grindr is a unique social network mainly targeted at gay men focusing on casual relationships. Launched in 2009, well before the debuts of Tinder (2012) and Bumble (2014), Grindr is one of the oldest and most established dating apps still in operation today. In the U.S., an estimated 7-10% of the population identifies as LGBTQ, a percentage that has been rising alongside increased societal acceptance, as shown in the below chart, equating to a potential US user base of around 10 million gay men. Grindr's global reach extends beyond the U.S. with 40% of revenue coming outside of the US. With approximately 4.1 billion men worldwide; assuming a 10% gay population, the company's total addressable market could reach as high as 400 million users, provided same-sex relationships are legally and socially accepted in all countries. Currently, Grindr boasts around 15 million monthly active users, making it the largest platform for the gay community, though it has yet to fully penetrate its sizable potential market.

Gay men tend to have higher disposable income than the rest of the population and to use dating apps twice as much. Gay household incomes are approximately twice as high as the national US average, according to U.S. Census data, making this demographic particularly attractive for a subscription-based business model. Given the relatively smaller dating pool for gay, they are more inclined to use dating apps, with Pew Research Center data indicating that gay adults are twice as likely as straight adults to have used a dating app in the recent past, with 50% of U.S. gay adults reporting such usage.

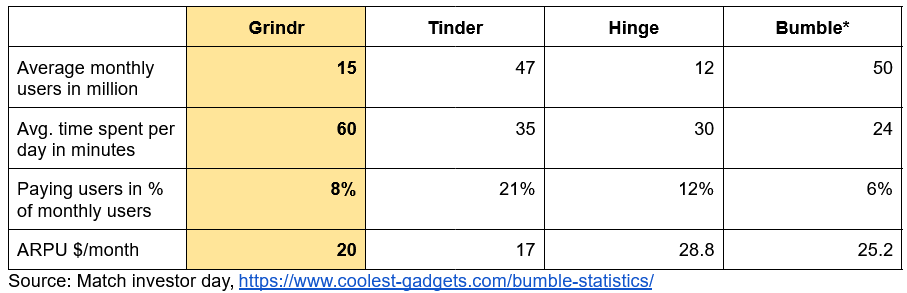

Grindr is the dominant gay dating app with 90% brand awareness in the US and 60% globally, creating strong network effects. The biggest lie in dating apps is that users want curated matches. Grindr is the opposite — more people, less friction. The app shows users a grid of profiles sorted by proximity, turning the whole experience into a game of speed and luck rather than endless swiping. This dynamic creates a deep moat for first-mover Grindr, explaining why no other app has been able to make significant inroads into its dominant market position. Grindr currently boasts around 15 million monthly active users (MAUs) who spend an average of over 60 minutes per day in the app – a figure closer to social media engagement metrics (TikTok and YouTube average 45 minutes each) than other dating apps (Tinder averages around 35 minutes). Grindr is more addictive than TikTok — but so far, it's barely begun charging for it. Despite its widespread popularity and high user engagement, Grindr has significant potential for further monetization by increasing the proportion of paying subscribers and driving higher average revenue per user (ARPU). All else equal, reaching 12% paying users, similar to Hinge, would bring in another USD 144m, or a 40% increase in revenue!

The company has been under-invested prior to its IPO and has many levers to support growth in the double digits in the coming years. Grindr's corporate journey has been complex since its Israeli founder sold a large stake to a Chinese company in 2016. This ownership change led the U.S. government to demand the Chinese owner to divest Grindr given the access to sensitive information, resulting in its acquisition by an American buyer in 2020. Grindr then went public through a SPAC IPO in 2022, and new CEO George Arisson joined the company that same year. Since taking the helm, Mr. Arisson has focused on addressing the technology debt to establish a solid foundation, and as highlighted during the last investor day, he is now prioritizing business growth. The chart below illustrates Grindr's best-in-class margins compared to its peers, despite lower monetization. Currently, management plans to maintain flat margins while reinvesting growth into the business.

Source: Match Group investor day presentation, AOI: adjusted operating income

MAU should accelerate to high single digits/low double digits driven by better marketing and international expansion. Grindr has significant opportunities to raise its profile through increased marketing efforts, an area that was previously neglected. Additionally, the company is working to ensure its product can address a broader range of user needs, with both "Right Now" and "Long-term" focused offerings in development. Grindr is also embracing international expansion by adapting the app to cater to local markets (e.g. Japan), rather than solely offering an English-language version. In 2024, Grindr derived c.60% of revenue from North America and another 23% from Europe, the international opportunity is large.

“Gayborhood expansion” is not in the guidance but looks promising. Grindr is experimenting with local discovery features that let users browse events, nightlife, and businesses based on location and profile data — turning the app into a community platform rather than just a hookup app. Similar to Spotify recommendation for local concerts based on users’ locations and tastes. If successful, Grindr could build an entirely new revenue stream with no cannibalization risk.

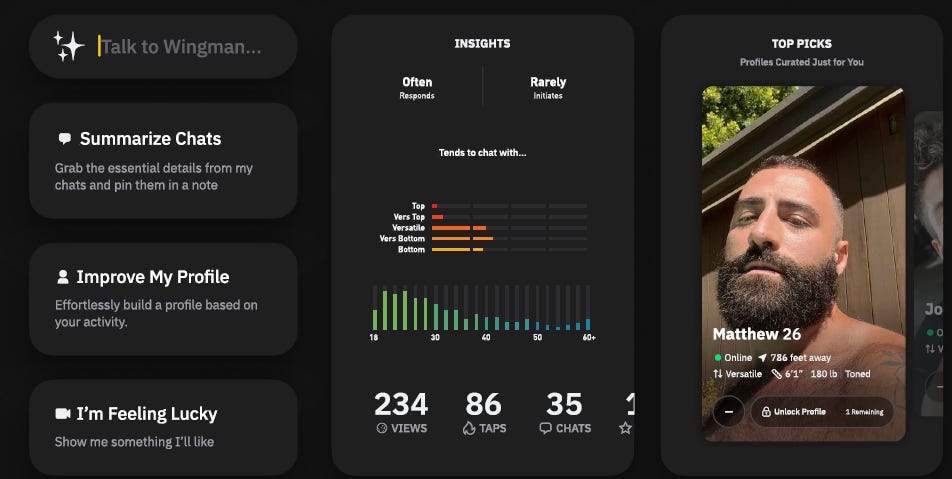

Monetization should continue to improve thanks to better conversion and new offerings. Grindr's paying user base has crossed the 1 million threshold in 2024, representing approximately 8% of its total monthly active users (MAUs). Until 2023, Grindr had a single subscription tier called Xtra, priced at $25 per month. In 2024, the company introduced a higher-tier offering called Unlimited, priced at $50 per month. Both the Xtra and Unlimited subscriptions saw price increases in 2024, rising to $30 and $60 per month, respectively. In addition to these core monthly subscriptions, under the leadership of CEO George Arison, Grindr is now introducing several paying "add-on" features for power users who want to increase the visibility of their profiles or interact with people in a location before visiting (“Roam”). The company has also been developing an AI-powered paying "wingman" feature, which will leverage users' profile data to improve their own profiles and recommend other users based on common interests and characteristics, as shown in the slide below. These new functions and features are expected to be deployed within the next 2-3 years, and they have the potential to accelerate Grindr's growth beyond management's current expectations.

source: Grindr Investor Day

Management targets to reach EBITDA of USD 245m by 2027 equivalent to +20% p.a. seems reasonable. To achieve this, the company needs to grow its global paying user base by approximately 8% per year, while also increasing average revenue per user (ARPU) by around 8% annually. Given the favorable demographic dynamics mentioned earlier, low-hanging fruit on the marketing side as well as Grindr's expansion into new markets and the introduction of add-on products, these growth targets feel conservative. There could also be upside potential if Grindr's EBITDA margin ends up higher than the 42-43% range that management has targeted. The company demonstrated a 45% EBITDA margin in Q3 2024, suggesting the potential for higher margin level. Advertising has been another important revenue driver for Grindr, and a recent executive hire from Google is expected to help the advertising business grow in lockstep with the rest of the company. However, management does not anticipate advertising becoming a relatively larger portion of the overall revenue mix, with the current 14% contribution expected to be maintained.

source: Grindr, Elevator Pitch

Solid balance sheet and potential returns to shareholders in the future. Grindr ended 2023 with ND/EBITDA of 2.7x and they are targeting to continue decreasing the debt thanks to a FCF conversion of c. 70%, I expect they end 2024 around 1.4x ND/EBITDA. Given how asset light the business is, the company may be soon in a position to start returning cash to shareholders.

Grindr is walking a tightrope between monetization and usability. The app's power users will pay — but if Grindr goes too far in gating core features behind paywalls, it could drive away the free users that sustain the network effect. Recent reviews on the app stores as well as anecdotal evidence from the grindr reddit are already pointing to some users finding the new monetization schemes drove a decrease in the app usability. Grindr needs to manage the balancing act of trying to push users to buy premium through better features while not discouraging new or free users to engage.

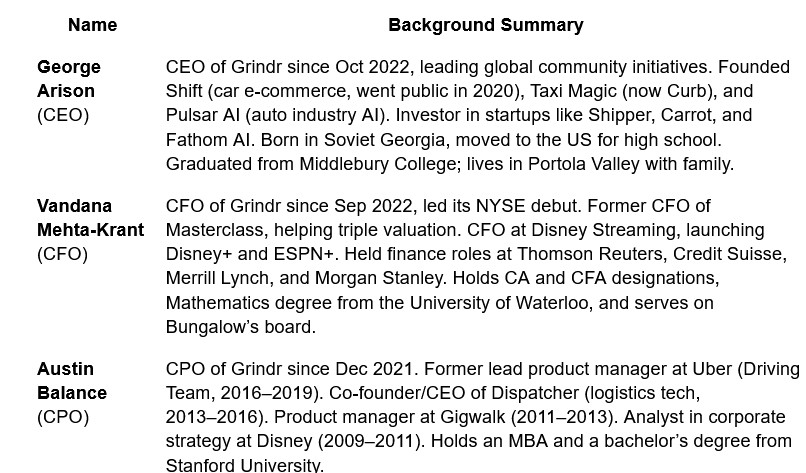

Although executive management has mainly joined in the last two years, they are experienced and the recent investor day shows a strong commitment to growing the business. The board is still dominated by the leading shareholders, ideally we would see new experienced independent board members being nominated in the coming years.

Bottom line: Grindr turnaround is in the early innings and looks promising. With a clean balance sheet, 40%+ margins, and double-digit growth ahead, the stock looks reasonably priced at 19.9x EV/EBITDA 2025E — with upside optionality if the Gayborhood vision materializes.

If you enjoyed this writeup please subscribe to the substack and share. I am always looking to improve so don’t hesitate to leave a comment or let me know by direct message! You can also find me on x.com @ElevatrPitchGuy or on Bluesky @elevatorpitch.bsky.social.