Before we dive in, I’m excited to share that I’ve launched a podcast to bring my writeups to life and answer questions I receive! You can subscribe on Substack directly, or catch it on Spotify if that’s your go-to platform (Apple podcasts coming soon).

The elevator pitch: MIPS is a hardware technology company that offers a patented system integrated into helmets to significantly reduce brain injuries during falls and collisions. By partnering with helmet manufacturers as an “ingredient technology”, MIPS enables them to upsell consumers based on proven safety claims supported by MIPS's marketing efforts. The company has a track record of incredible growth within the the US bike helmets market and very high profitability thanks to their asset light model. Growth should continue driven by penetration in Europe, and expansion into the motorcycles and safety adjacencies, supporting revenue growth in excess of +30% CAGR 2024-2027E and margin expansion through operating leverage driving EPS growth above 45% CAGR 2024-2027E. With a ROIC of 80% in 2024, MIPS generates high FCF, which is supporting a dividend payout ratio above 50%. Net cash position of c.3.5% of the market capitalization gives the company a solid setup to continue growing with optionality for further returns to shareholders or M&A. Valuation above 50x P/E NTM is demanding although in line with historicals levels and a DCF valuation points to further upside. The main risk to the thesis would be a lower than expected TAM preventing the growth to materialize.

MIPS is the “gore-tex” of helmet safety. Over the past 25 years, MIPS has developed a system that can be integrated into various types of helmets—such as those for biking, skiing, motorcycling, and equestrian sports—to provide added protection against harmful rotational forces during falls. This technology was initially created in the 1990s by a brain surgeon from the Karolinska Institute in collaboration with an engineer from the Swedish Royal Institute of Technology, before being spun off into a private company. MIPS holds approximately 400 patents that protect its technology. The effectiveness of this system has been scientifically validated through numerous studies, including independent research that has highlighted the dangers of rotational forces in bike accidents. Rather than entering the highly competitive helmet manufacturing market, MIPS has smartly chosen to pursue an "ingredient technology" strategy. This approach allows MIPS to supply its essential component to helmet manufacturers, who then select specific models and design them for compatibility. In exchange, MIPS receives royalties for permitting these companies to utilize the MIPS brand and safety claims in their marketing efforts.

Source: MIPS

MIPS uses a clever marketing strategy to drive growth in the premium helmet market, creating a virtuous flywheel. MIPS helmets are positioned as premium products, typically priced $20 to $40 more than their non-MIPS counterparts. The MIPS system serves as a key differentiator, allowing manufacturers and retailers to effectively upsell customers and enhance profit margins for both parties. The MIPS badge capitalizes on consumer psychology; many customers are willing to invest a modest amount compared to the overall price of $200+ for premium helmets to gain added protection in the event of an accident. To address the challenge of promoting a system that is integrated within the helmet and not visible when worn, MIPS has implemented a smart marketing strategy. The company requires manufacturers to prominently display the bright yellow MIPS badge on the exterior of the helmet (see picture below). This approach doubles as a marketing tool, leveraging each helmet to spark word of mouth and amplify brand awareness. Anecdotal evidence from biking forums indicates that consumers demonstrate strong brand loyalty; once they purchase a helmet featuring the MIPS system, they are likely to keep buying them, even if they switch to a different helmet brand. Currently, MIPS enjoys 45% brand awareness in the U.S. and 35% in Europe. The company has set an ambitious goal to further increase this awareness by allocating 7% of its yearly revenue to marketing initiatives, including in-store displays and targeted campaigns.

MIPS VIRTUOUS FLYWHEEL

Source: the elevator pitch

MIPS has primarily found success in U.S. bike helmets, supported by a well-developed supply chain and limited competition. The sports division dominates revenue, with bike helmets accounting for 75% of total sales and other sports (snow, equitation, etc.) adding 15%, collectively driving 90% of total revenue. The Company is partnering with over 150 brands globally across more than 1,000 helmet SKUs. MIPS operations are asset-light and well optimized. The company only has 110 employees mainly in R&D, while the manufacturing of the MIPS inserts is done in Mexico and China, next to their customers’ large factories. Competition has been benign with no other meaningful technology emerging in that niche over the last twenty years. Now that MIPS has grown in awareness and is spending a sizable USD 3-5m p.a., and growing, on marketing, it is difficult to disrupt. Manufacturers also have little incentives to have too many conflicting “standards” or “labels” that may confuse customers. As a result MIPS has no competition here, outside of manufacturers opting not to include it in their helmets.

MIPS REVENUE BY HELMET TYPE AND GEOGRAPHY

MIPS ASSET-LIGHT SUPPLY CHAIN

Source: MIPS. Although the above chart only references China, the supply chain is the same for the Mexico outsourcing partners that serves the US.

MIPS has had an incredible growth but suffered from the covid reversal. MIPS has significantly benefited from the surge in cycling during the COVID-19 pandemic, which accelerated user adoption by several years. In line with trends observed across the leisure sector, MIPS experienced a remarkable 66% increase in sales in 2021, as retailers anticipated the continuation of this momentum. However, 2022 saw a decline in sales, followed by clearance events and minimal ordering in 2023, which effectively reset inventory levels to a more sustainable state. 2024 return to growth (+35%) was a positive sign the covid disruption is mostly over. Although it created volatility, covid brought more users to cycling and sustainably grew the TAM, which is positive in the long term for re-equipment sales (every 5-8 years).

Source: MIPS, the elevator pitch

MIPS targets to reach SEK 2bn of revenue by 2029 through European expansion and growth in adjacencies. In 2022 boosted by the rise of people biking, MIPS sold 12.6m systems (each MIPS helmet has one system inside), the company then stopped disclosing that number, but based on earnings calls comments and trend analysis I believe that number decreased to about 10m systems sold in 2024 as the market digested the equipment surge as well as some destocking. From that base onwards, MIPS has three main growth levers:

Expand in Europe. Europe is a market of c. 25m sports helmets and MIPS believes they have a c.15% market share, they are targeting to reach 50% market share, similar to their current share in the US. → That would imply an additional 12m units by 2029 representing half of the expected growth.

Continue to expand in Moto. Moto currently accounts for 8% of MIPS's net sales, translating to approximately 1 million units. This segment represents a new market for MIPS, characterized by a higher frequency and severity of accidents compared to cycling. MIPS has effectively established partnerships with 10 brands, including well-known names like Bell, which have previously recognized MIPS's expertise in the cycling industry. → If MIPS captures 20% of that market within the premium segment that’s about 8m additional units.

Expand into Safety: In 2021 MIPS identified professional helmets (construction, public works, police forces, etc…) as a new growth avenue. Safety has had a good start and represented 4% of revenue in 2024. → Assuming MIPS gets to 3% market share of the 110m helmets they target by 2029 that’s an additional 3m systems sold.

→ Based on those assumptions, MIPS could grow volume organically by c. +30% p.a. 2024-2029. Keeping the c. SEK 50 of revenue per system that MIPS historically has made and assuming no pricing/mix, those 38m units would be worth SEK 1.9bn revenue, close to management’s 2029 target of SEK 2bn.

Note on pricing: MIPS has historically made about USD 5 per MIPS helmet despite the additional cost to the consumer of USD 20-40, leaving the helmet manufacturer a large share of the economics to incentivize them, and the remaining going to the outsourcing manufacturing partner of MIPS (as MIPS does not manufacture in-house).

HELMETS MARKET BY CATEGORY AND MIPS RIGHT TO PLAY

source: MIPS, the elevator pitch

Growth optionality from new product launches and international expansion. In addition to its core system, MIPS has been working on improvements and new innovations that enhance protection and can be sold at a premium. Currently, MIPS offers 7 variations of its core system, ranging from the basic model to more advanced options that include features such as energy absorption and textile integration for ski helmets. Many of these innovations have been recently launched, allowing MIPS to provide more differentiation for manufacturers within their helmet lines and generate pricing power. The company has also started developing a kids' product line, which is particularly appealing since parents are often willing to invest in extra safety features for their children. Additionally, MIPS is focusing on the moto, scooter, and e-bike markets in countries like China, India, and Brazil, where changing regulations and usage trends are boosting helmet adoption and premium options.

An asset light business with potential for EBIT margin above 50%. MIPS has a small cost base as they outsource manufacturing (c. 70% gross margin), their main expenses are marketing at c. 7% of net sales and R&D at 5% of sales with the remaining being G&A that should scale up with revenue given the small footprint of the company. MIPS management targets 50% EBIT margin by 2029 which seems reasonable given the 54% EBIT margin reached in peak covid time in 2021. The company has no capex (c.1% for development) and as a result most of the EBITDA is converted in FCF (c.95% conversion ratio historically). The company targets to pay at least 50% of EPS in dividends although they have been above that level for the last two years due to covid and I expect dividend per share to continue increasing in absolute value.

MIPS has no debt and sits on c. 3% of the market cap in cash. MIPS has been a pure organic growth story and has never raised debt, as a result, outside of the generous dividend, cash has been accumulating on the balance sheet, culminating in 2024 with SEK 225m net cash, equivalent to 3.5% of the company’s market capitalization. Management said they could consider buybacks at some point.

The main risks for the company relates to a slowing consumer environment, as well as some customer concentration. With virtually no competition and high barriers to entry from both an R&D and helmet manufacturing standpoint, MIPS is primarily at risk from a potential slowdown in consumer spending on leisure activities, which could hinder volume growth. The helmet manufacturing landscape is quite concentrated, with MIPS serving around 150 customers, of which the five largest account for 44% of sales. However, as the company expands its footprint in the Moto and Safety segments, this concentration is expected to decrease, leading to a more diversified customer base. Additionally, tariffs are not anticipated to be a significant concern for MIPS, as all contracts are structured under Incoterms Ex Works. This means that the buyer assumes responsibility for all transport costs, duties, tariffs, and related expenses, effectively reducing MIPS's exposure to these factors.

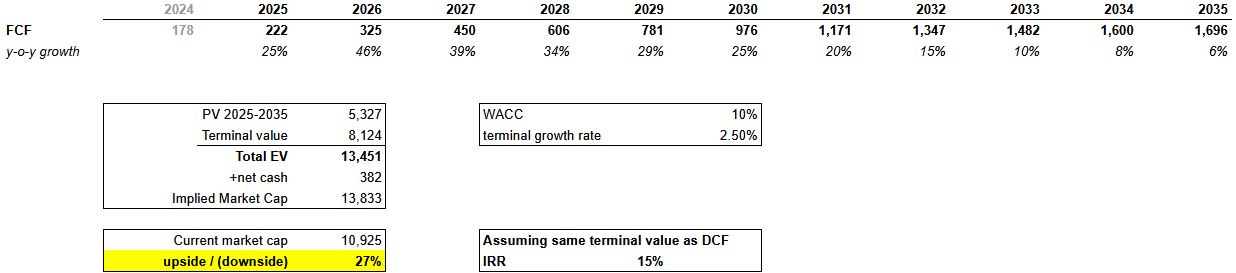

MIPS valuation is demanding at c. 50x P/E NTM but a DCF and exit multiple analysis points to further upside even if the multiple contracts meaningfully. MIPS currently trades at approximately 50x P/E NTM, which is at the high-end of its historical range ex covid of 40x-50x despite a year-to-date decline of 12%. One could argue that the company is still in a recovery phase following inventory destocking, which may be slightly depressing earnings and making the multiple appear higher than it actually is. Using a DCF valuation with a 10% WACC (with no debt) and a 2.5% terminal growth rate, I reach a present value of SEK 13.8 billion, suggesting a potential upside of 27% compared to the current market capitalization. Alternatively, a reverse DCF analysis indicates that the current market cap implies a 15% internal rate of return (IRR). Both of these figures align well with my return objectives for a high-quality company of above 10% p.a. Additionally, the dividend yield of 1.3% provides some downside protection, and the company has demonstrated a commitment to growing its dividend payments.

From an exit P/E NTM perspective, on a 5 years view the below green areas show where total shareholder returns would be higher than 10% p.a. for a given exit P/E multiple (left column). I do believe MIPS’s multiple will come down as the growth story normalizes once penetration in Europe is mainly achieved. As a result an exit P/E around 25x for an EBIT margin over 50% seems reasonable. Based on my estimate for a SEK 29.18 EPS in 2029 it would leave a total return in the 8-18% range. I would need to be wrong by c. -20/-40% on my EPS and for multiple to contract below 20x for returns to turn negative, which could happen if management overestimated the market size but does not seem the most realistic scenario.

SEK YEARLY TSR SCENARIO ANALYSIS BASED ON EXIT MULTIPLE AND EPS

Management is very Swedish but navigated the covid period well. CEO Max Strandwitz was appointed in 2019, and CFO Karin Rosenthal joined in 2020. They both took on their roles during a time of significant volatility for MIPS. Impressively, they managed to avoid overextending the company during the sales boom in 2021 and therefore didn’t have to make drastic cuts in 2022 or 2023. They also kept the dividend intact during those tough years, showing their commitment to returning value to shareholders. The board consists of six independent and well-qualified members, but it leans heavily towards a Swedish background. I believe MIPS would benefit from a more diverse and international board to bring in different perspectives and better align with its global market presence.

Disclaimer: Not your financial advisor, do your own research, I may have positions in the names I discuss. Stocks may go up or down, and sometimes we won’t know why.