Starbucks (SBUX) has been an amazing success story, from (almost) rags to riches built on one man's conviction that he could do coffee shops differently. For the longest time SBUX was a no-brainer investment, with increasing cultural relevance in the US and internationally. With c.41k stores globally and more than USD 35bn of revenue, Starbucks is the largest coffee chain in the world.

USD 100 invested at IPO in 1992 would currently be worth USD 24k or an annualized price return of 18% p.a. (despite the recent under-performance) well above what the S&P 500 or MSCI World have delivered since then.

However since 2018 the business has struggled and the strong covid performance has left place to structural interrogation around the business model which have been compounded by several changes of CEO. In 2017 Howard Schultz stepped down and Kevin Johnson was chosen as CEO, with a strong tech background he was to develop Starbucks digital offering. Although he was successful on that aspect with mobile ordering taking off meaningfully, his leadership also created several issues with employees resulting in a large unionizing movement as employee turnover started to skyrocket. Schultz came back as a CEO in spring 2022 (his third time returning to the helm) to try and get the company back on track, but as shown below the stock price has meaningfully under performed since then as issues started to pile on.

Source: Starbucks, Google Finance

Starbucks faced significant challenges stemming from its own success and evolving consumer habits, the key issues below are well-understood but hard to fix

Increased menu complexity and customization: This led to longer wait times, frustrating casual customers and negatively impacting the overall experience. However customization are extremely high margins for SBUX and limited time offering (LTOs) a key traffic driver.

Inadequate store layouts for changing consumption: Stores were ill-equipped to handle the growing preference for mobile ordering, pick-up, and drive-through, exacerbating wait times and increasing employee stress.

Employee dissatisfaction and unionization: High stress levels and poor scheduling fueled a widespread and public unionization effort.

Price sensitivity: Post-COVID price increases began to exceed the tolerance of even loyal customers.

Schultz came back in 2022 with a plan to overhaul the crafting flow. Starting with a new coffee machine called Clover Vertica which could deliver coffee much faster (c.30 seconds for base recipe - see video below) and with less human intervention, and the new “Siren system” which is a new in-store organization+new digital tools that aims at streamlining drink crafting and decreasing wait times, while having store layout more adapted to the new distribution channels. A bit of hope was instilled back into the stock price which rebounded strongly in Fall 2022.

Early 2023 it was announced that Laxman Narasimhan would become CEO. Laxman, a former McKinsey consultant and Pepsi executive was an odd choice given his lack of experience in the restaurant space. His plan for SBUX, summarized in the picture below were a continuation of Howard’s 2022 plan. He also stuck with Howard’s mid term target of 15%+ p.a. EPS growth, which seemed ambitious given the areas that needed work and constrained his ability to invest back in the business.

Source: Starbucks investor day 2023

Unfortunately the initiatives were too slow to show results and US SSS, as shown below, started to decelerate meaningfully with volume down mid single digit driving the entire SSS into negative territory as tickets plateaued at c. +3-4% growth. In parallel international SSS also started to go negative, with China struggling to compete with the many new concepts that had opened and were undercutting Starbucks on price. By Summer 2024 Laxman was fired and SBUX stock price was back to where it was when Howard took over from Kevin Johnson in 2022, a full round trip in the space of two years.

To replace Laxman, Starbucks managed to convince rock star CEO Brian Niccol to join Starbucks in October 2024. Stock price immediately went up. Brian had built his reputation by turning around two restaurant chains: Taco Bell and Chipotle. At Chipotle he took a company which was still reeling from e-coli scandals and made it one of the staples of the US restaurant landscape. Under his four years of leadership Chipotle delivered 40% annualized return, handsomely beating the benchmarks.

Once confirmed, Niccol outlined his strategic priorities in an open letter, with a clear emphasis on revitalizing the US market. Key initiatives include resolving morning peak hour congestion and prioritizing personalized orders, which offer significantly higher profit margins. Additionally, Niccol aims to restore Starbucks' reputation as a "third place" and improve employee morale. Consequently, Fiscal Year 2025 is projected as a period of strategic investment with no EPS growth, a little bit of "kitchen sinking," from Niccol as is traditional for new CEOs (which Laxman should have done!).

“These results are far below our capability, but I believe they will be temporary because there is so much opportunity in front of us. I also believe there are better measures than EPS right now to track the progress we're making to turn around the business”

Brian Niccol, Starbucks Q2 call - 29/04/2025

So is Starbucks attractive again? Starbucks remains one of the most loved brands in the world with a highly desired product in a growing category. So far we are seeing some positive signs with employee turnover dropping below 50%(!), customer waiting times are improving, and stores with positive SSS are increasing in the mix (about 25% last quarter from 13% previously). As FY25 (end September) will be a year of investments (more employees doing more hours + Siren deployment) margin will contract in the US while international is put on the back-burner. Below is how I see the two most extreme paths for Starbucks as a company, with the highest likelihood scenario falling somewhere in the middle.

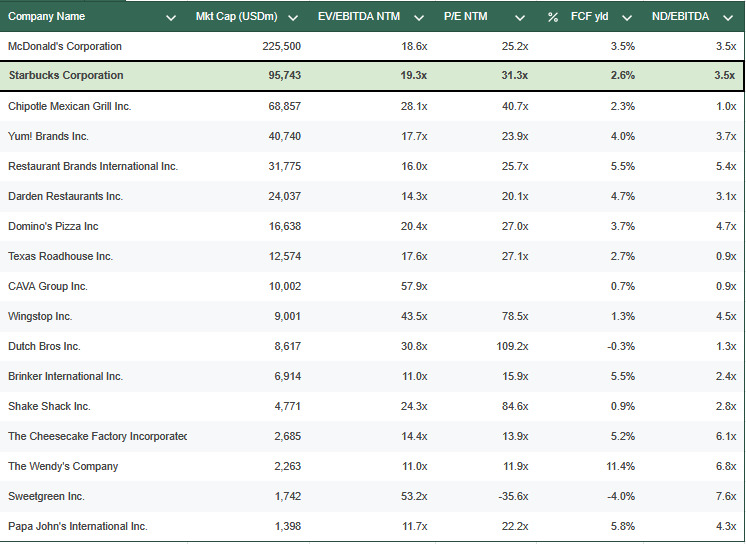

Valuation is still demanding. Looking at the below table, at EV/EBITDA NTM at 19.3x Starbucks is still more expensive than McDonalds at 18.6x or RBI at 16.0x, both companies have less issues than SBUX and more visibility to growth at the moment. Current debt level of 3.5x is also not ideal given SBUX is an asset heavy business that owns most of their stores.

➡️Starbucks' challenges, even if rooted in its past successes, are significant, and it's unclear how long it will take to resolve them. Historically, turnarounds of large brands are difficult and often slow. For that reason, it's usually wiser to wait for early signs of recovery before investing. While this approach risks missing the initial upswing, the alternative is to be stuck with a stock price going nowhere until things start turning.

As always, I'm eager to hear your thoughts and feedback, which you can share directly with me through Substack or find me on X.com, Threads, or Bluesky. Your input helps me refine my ideas and create more relevant content, so please don't hesitate to reach out!

Disclaimer: The content on this Substack is for informational and educational purposes only, reflecting the author's personal opinions, and should not be construed as investment, financial, legal, or tax advice; its accuracy or completeness is not guaranteed. The author may hold positions in any companies or investments discussed. All investing involves substantial risk of loss. You are solely responsible for your own investment decisions; always conduct your own thorough research and consult with a qualified financial advisor before making any investments. The author and this Substack disclaim any and all liability for any losses or damages that may result from the use of information provided herein.