Dear subscribers, today I am sharing a different kind of write up. I'm excited to introduce 'What's up with...?', a format where I'll be taking a closer look at some of the stock/sectors behaviors that makes us go “what’s up with…?’”. Let me know what you think and don’t hesitate to share if you find it insightful! — Greg

The elevator pitch: Ulta, a long-time US investors favorite, has struggled to regain momentum since COVID ended, the stock is down c. -40% from its peak in early 2024. The company's pandemic-era "bust and boom" was followed by a significant increase in competition, driven mainly by Sephora's aggressive expansion through its partnership with Kohl's. This perfect storm of challenges has resulted in underwhelming performance, ultimately leading to the sudden departure of CEO David Kimbell in January 2025, leaving Ulta in limbo.

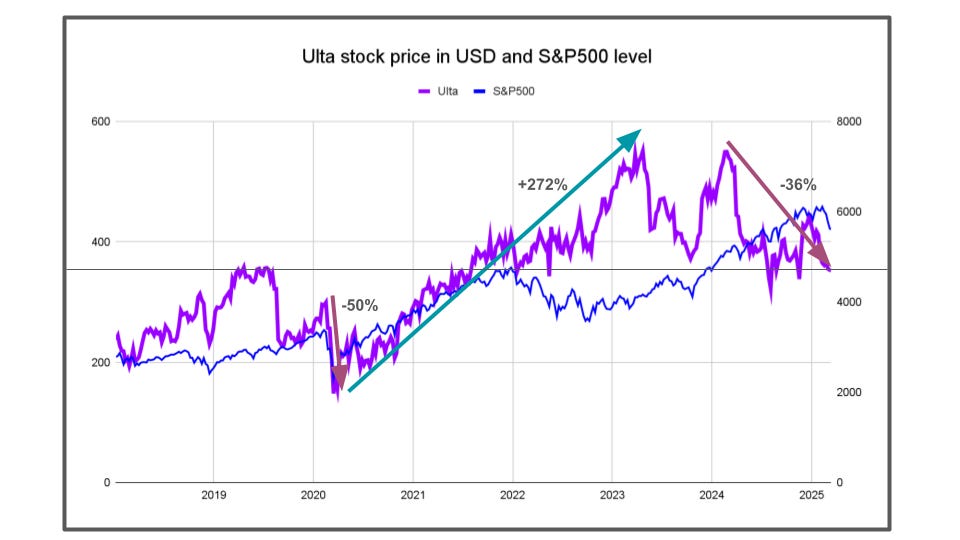

Ulta has been a volatile stock over the last five years. When COVID hit, Ulta's stock initially tanked 50%, similar to many brick-and-mortars retailers. However it quickly became clear that the company was doing a good job with e-commerce, and the surge in disposable income from people stuck at home, combined with government subsidies, sent the demand for beauty products soaring. The trend continued well into 2023, pushing the stock price to an all-time high of $550. However things started to turn sour in 2023 when comparable sales growth and margins levels started contracting, driving the stock down almost 40%. It's been a wild ride for investors who thought they had a safe compounder in Ulta, a staples specialty retailer in a stable beauty market with a track record of good execution and generous returns to shareholders.

Source: Yahoo Finance

Although it seems a lot happened at once, it’s worth distinguishing three key movements:

Pre-covid, looking at the 2016-2019 period the company had grown tremendously its store base getting to over 1,000 stores in the US, a doubling of footprint in five years. As a result, comparable sales (sales made only in stores already opened the previous years) were starting to normalize as incremental stores were generating less footfall and the ramp-up of opened stores was getting close to their optimal productivity. Ulta was on the way to maturing gracefully.

Covid “bust and boom”: COVID-19 triggered a wave of “boom and bust” scenarios across various industries. Companies like ZoomInfo and Domino's Pizza experienced significant sales increases during the pandemic, only to face normalization as the lock-downs ended. In contrast, Ulta went through the opposite trend: a bust followed by a boom, alongside sectors like hotels and spirits. Initially, the pandemic posed an existential threat to retailers like Ulta when no one could shop in stops anymore. However, as consumers found themselves with extra disposable income and a higher focus on self-care, Ulta capitalized on this shift, including through their relaunched e-commerce platform, leading to a remarkable rebound in comparable sales that surpassed pre-COVID levels.

Normalization + Sephora@Kohl’s: Under normal circumstances, we would have expected comparable sales to come down with a few weak quarters and then return to mid-to-high-single-digit industry growth post-COVID. However, in 2021, Sephora, the high-end beauty retailer owned by LVMH, launched an aggressive expansion by opening stores within Kohl’s stores, similar to Ulta's partnership with Target. Historically, Sephora had limited U.S. locations, primarily in city centers and airports. By leveraging Kohl’s locations, they targeted the same customer base as Ulta, attracting shoppers drawn to Sephora's "prestige" image despite an overall very similar product offering. Over the course of 3 years, Sephora opened 1,000 stores which are generating USD 1.8bn of revenue in 2024. Ulta admitted that 90% of their own stores had been impacted by new competitors' openings and that they had lost market shares.

Source: Ulta and Kohl’s

Management compounded the issue by not being straightforward in their messaging. I believe Ulta's management has mishandled expectations, contributing to negative sentiment around the company. To provide some context, in 2022, during their investor day, Ulta set mid-term guidance of +5-7% annual revenue growth, and a target EBIT margin of 13-14%. This margin was notably higher than Ulta's historical level, leading some to argue that the company deserved a higher valuation than in the past. Issues arose in early April 2024 when David Kimbell, at the JP Morgan Retail Conference, acknowledged a faster-than-expected slowdown in their categories, causing the stock to drop nearly 40% in just a few months. The market dislikes uncertainty, and Ulta's vague communication about what was normal covid normalization versus the impact of Sephora at Kohl’s participated in the loss of trust in the company’s potential and the stock price decline. I believe that faux pas was a key reason David was unexpectedly replaced in January 2025.

EXTRACT FROM JPM RETAIL CONFERENCE - 3 APRIL 2024

What we’ve seen so far is a slowdown in the total category across price points and segments. That’s a bit earlier and a bit bigger than we thought. Still growing, still a lot of engagement, all those things that I’ve had, but we’ve seen this growth rate come down probably faster than we anticipated. We’re watching and monitoring closely on that, staying very close to our guests. […]And the other things that are going on in our consumers’ lives has led to a bit slower growth than we had anticipated in the category so far this year.

David Kimbell

CEO (2021-2024)

A lukewarm investor day and more uncertainty. In Q1 2024, Ulta lowered its guidance, reinforcing the perception that the company was struggling. While Q2 showed some improvement in sentiment, shareholders looked forward to the investor day in October for better news. Unfortunately, the 200 slides, detailed yet vague presentation failed to impress, revealing underwhelming growth targets of mid-single-digit revenue and a 12% EBIT margin—figures that do not justify a premium valuation compared to other retailers. Expectations for a special buyback were also squashed as the company continued with its c. USD 1bn p.a. shares buy back program.

A new hope CEO: In January Ulta surprised the market by retiring CEO David Kimbell and nominating then COO Kecia Steelman (former Family Dollar Stores and Home Depot) who had been with the company since 2014 and the COO since 2021. Last week (13 April 2025) was Kecia's first call, reporting a strong quarter but admitting the struggles and market share losses of 2024. Kecia highlighted some executive changes and reorganization as well as pushing the same initiatives discussed at the investor day: (i) drive core business growth by reinvesting in store and better brands curation, (ii) scale new businesses which comprises e-commerce, wellness and international (which so far is only the Mexico expansion with a partner) and (iii) “realigning the foundation” this one sounds like consultant speech for reorganization and layoffs, which it probably is.

EXTRACT OF ULTA Q4 EARNINGS CALL - 13 MARCH 2025

The beauty landscape has fundamentally changed. Guest expectations continue to rise, and the pace of change is accelerating. The competitive environment in beauty has never been more intense. For the first time, we lost market share in the beauty category in 2024. I am aware of the challenges that we face. Some of them are external, while others we own.

Kecia L. Steelman

CEO (since January 2025)

So should you look at the name? Ulta has an impressive history of growth, disciplined capital allocation, generous returns to shareholders and very little debt (0.7x ND/EBITDA 2024). They are participating in one of my favorite categories: Beauty, which has a track record of sustainably growing mid single digit p.a. globally (see bonus chart at the end) and they have a strong brand, impressive loyalty program, and great store locations. On the other hand, it is an asset-heavy business with limited scalability once stores reach optimum productivity, challenges in the online channel, and no significant international growth to date (Mexico is not yet live). They are being challenged by a very strong franchise with Sephora@Kohl’s, backed by deep-pocketed LVMH. In online they also face Amazon developing brand shops in prestige beauty with Estée Lauder. Below is a back of the envelope scenario analysis for Ulta, if consensus is right, and that’s also management guidance, and the multiple stays at 16x P/E NTM then price return over the next two years should be in excess of 10% p.a. (my personal threshold to look at names). If they struggle to compete and the margin does not expand above 12% then it’s hard to find it attractive here.

Within the beauty space, I have always preferred to get exposure through brands. They come with different challenges but they are more diversified globally and they can win across channels. Although I can see the appeal of Ulta at the current valuation.

VALUATION TABLE - SELECTED BEAUTY COMPANIES

Source: yahoo finance, as of 14/03/2025

A bonus chart of why I like the beauty end-market so much

Source: L’Oréal estimates of the worldwide cosmetics market based on net manufacturer prices. Excluding soap, toothpaste, razors and blades. At constant exchange rates.

As always, I'm eager to hear your thoughts and feedback, which you can share directly with me through Substack or find me on X.com, Threads, or Bluesky. Your input helps me refine my ideas and create more relevant content, so please don't hesitate to reach out!