🇺🇸🏋️♀️The Secret Strength of Planet Fitness: A Deep Dive into the Gym Giant

Exploring the Drivers Behind Planet Fitness's Market Dominance

The Elevator Pitch: PLNT is the leading gym franchise in the U.S. with c. 20 million members and an asset-light, franchise-driven model generating strong, recurring cash flow. Its 10-year franchise agreements and low-cost, auto-renewing memberships result in low churn and high gym utilization. Structural tailwinds—from growing wellness trends to an aging population—are fueling >10% annual EBITDA growth. With a high-margin profile, I expect EPS to compound at a 14% CAGR from 2025E-2028E. While the 19x EV/EBITDA NTM valuation is demanding, it reflects the business’s resilience in a current volatile macro environment and there is optionality from a successful European expansion.

Planet Fitness (PLNT) is the leader in US gyms with c.20m members. The company operates an asset-light franchise model within the “high-value low-price” segment with among the best four wall margins of the industry at c. 35-40%. US gyms memberships have been growing faster than population growth in the US driven by the tailwind of “healthy ageing”. There are about 70m people with a gym membership (c.24% of adults) in the US and the growth is expected to be +3% CAGR 2025-2030. There are three main drivers behind that growth: (i) healthy ageing as the US people have less kids and live longer, the focus on wellbeing has increased, (ii) social media has increased people’s awareness of their appearances and fitness influencers are one of the most followed categories, (iii) GLP-1 drugs are allowing the 40% of the US adults currently obese to start losing weight and exercising. GLP-1 drugs also have an important muscle loss impact which requires people on medication to exercise. As shown below those factors have driven the rise in penetration in every generation, but particularly the youngest one.

US GYM GOERS PENETRATION RATE

Source: Planet Fitness

Planet Fitness dominates within its segment of “high-value low-price”. Planet Fitness’s concept of a large (c. 20,000 square feet ~ 1,800 meter square) standardized gym with a “Judgment free zone” where everyone whatever their body type can come and exercise has been a winning formula. The company is the most known gym in the US, they captured c.90% of the industry new members 2011-2019 and are 8x bigger than the next competitor with 30% market share of total gym goers in the US. PLNT's unique selling proposition is a low entry price of USD 15 per month and large, basic but well-equipped, clean gyms. PLNT gyms have no frills, no classes, no spa or any of the service from premium gyms which allow to keep personnel expenses and operating costs low. The USD 15/month (USD 10/month before 2025) make the value extremely high, even for members who cannot exercise everyday and allow PLNT to target the largest population pool, including beginners, lower income population and students. On top of the entry subscription (“White card”), PLNT also has a USD 25/month subscription, “Black Card” which allows members to exercise in any Planet Fitness in the US and to bring a person to the gym as well as benefiting from special amenities in the gyms. A key strategy of PLNT has been to upgrade members to the black card, as of 2024 64% of members were on the black card, a number that has been steadily rising since 2019 when it was 60%.

source: The Elevator Pitch

The gym space is still fragmented with limited meaningful competition. About 55% of gyms in the US are still independent (despite a large number closing down definitely during covid) but the space has been consolidating. Planet Fitness (c. 2,400 gyms), Xponential (2,680) and Anytime Fitness (2,500 gyms) are the three largest corporate groups in the US. Xponential is a collection of high-end studios with monthly fees upwards of USD 100. Anytime Fitness is a small format, privately owned focusing on urban locations. Within the HVLP segment Crunch would be the second largest gym with 442 locations, three times less than PLNT. Scale is important for two reasons: (i) advertising budget, as clubs pool budget together, large chains like PLNT can have higher marketing budget to recruit/retain members (PLNT has the highest brand recognition in gyms with c .75% of the US population knowing of the brand), (ii) locations: for members with the black card, they can exercise in any PLNT, for travelers or even just for people wanting a gym near the office and near home, a larger network is an advantage.

HVLP Gyms are attractive to operators thanks to sticky revenues and low variable cost, generating 40%+ EBITDA margin with asset-light properties and limited upfront cost. Gyms tend to have sticky members with yearly contract auto-renewing creating revenue stickiness. PLNT also relies on Automated Clearing House (ACH) instead of credit card which makes the subscription more resilient. Compared to high-end gyms that require employees to provide services including classes, HVLP gyms have minimal operational costs aside from rent and a receptionist/cleaning crew (often outsourced). Consequently, Planet Fitness franchisees can achieve a mature EBITDA margin of 35-40% (post 7% royalty fee), similar to high-end hotels, but with a much lower start-up cost (approximately USD 2.5-3 million currently, closer to restaurant average initial investment of USD 1.4m than hotels at USD 50m+). PLNT gyms are on the larger side; combined with the relatively low monthly fee, they are able to have more members per gym than the industry average. For instance, Planet Fitness typically has around 7,000 members per gym, while a high-end studio such as Orangetheory or Xponential can accommodate only about 500-1,000. As a result PLNT has had no issue finding operators and financial investors to open more gyms and support the unit growth of the business. Franchise owners concentration risk is limited with no large franchisee being above 10% of revenue.

4-WALL EBITDA MARGIN BY CONCEPT

Source: The Elevator Pitch, public reporting

In the US PLNT has a visible runway for growth from opening more locations and price taking. PLNT has been growing locations by +11% p.a. over the last ten years reaching over 2,500 gyms in the US. Going forward they have done extensive work to map how many locations they can open without cannibalizing themselves. They believe that number is c. 5,000 gyms which would imply doubling the number of US gyms. Although I believe PLNT can reach that number over time I am modeling conservatively about 160-180 new locations p.a. translating in c. +5% unit growth p.a. On the price/mix side, thanks to a two-tier offering, the company has mainly kept the USD 10/month price until the rise to USD 15/month in 2024 but regularly increased the black card from USD 19 to USD 25/month. PLNT has also been increasing the annual fee paid at renewal, generating some pricing despite the headline monthly price staying constant. On the black card, the price increase has been more regular, and management expects to continue taking pricing. Planet Fitness has increased subscription prices, yet it remains one of the most affordable gym options in the U.S. This price increase applies only to new memberships, making it less appealing for existing members with lower subscription rates to cancel, as resubscribing would cost more. Consequently, PLNT has historically maintained reasonably low member churn rates.

Royalty fee catch-up will be a +10% uplift to revenue at least. I think one of the most underestimated things about PLNT is the current uplift from both royalty fee increase as franchisee renew their contract to the new 7% royalty fee (versus low single digit ten years ago) as well as new members onboarding at the new membership prices. The below exercise shows theoretically if all members were on the new prices and all franchisees on the 7% royalty rate, there would be an implied immediate 12% uplift to revenue (and EBITDA given franchise are basically 100% margin).

Equipment represents c.20% of revenue and also comes with recurring qualities. Beyond aesthetics, the uniform equipment policy serves as a strategic retention mechanism. Should a franchisee decide to terminate their agreement, the obligation to return the branded equipment and purchase alternatives machines represents a significant financial disincentive. Furthermore, Planet Fitness ensures a recurring revenue stream by mandating the replacement of cardio equipment every 5-7 years and strength equipment every 7-9 years to maintain brand standards and operational compliance.

Spain is the first step towards replicating PLNT US success in Europe. Planet Fitness's international expansion has historically been driven by franchisee demand in Canada (83 gyms), Mexico (35), Panama (7), and Australia (24). More recently, the company has established its own clubs in Spain (8 gyms so far), replicating its successful model with a monthly fee of EUR 15, which is lower than many competitors. As shown below the US is the most penetrated country in terms of gym memberships, Europe is still relatively under-penetrated with a very fragmented local club base. Basic Fit (former 3i investment, listed on Euronext) is the only large chain in Europe with 1,575 clubs, triple the second largest PureGym. Basic-Fit is a well managed company but given they own the gyms, they have large capex expenses making them slower to open new gyms and the resulting debt to go with it (2.5x end of June 2024) as well as a convertible. So far PLNT management has publicly said they are happy with the Spain development with now 8 clubs and they are already working at refranchising them in the medium term. My current model does not have any meaningful revenue impact from international, but if PLNT manages to make it work, it would make current valuation attractive.

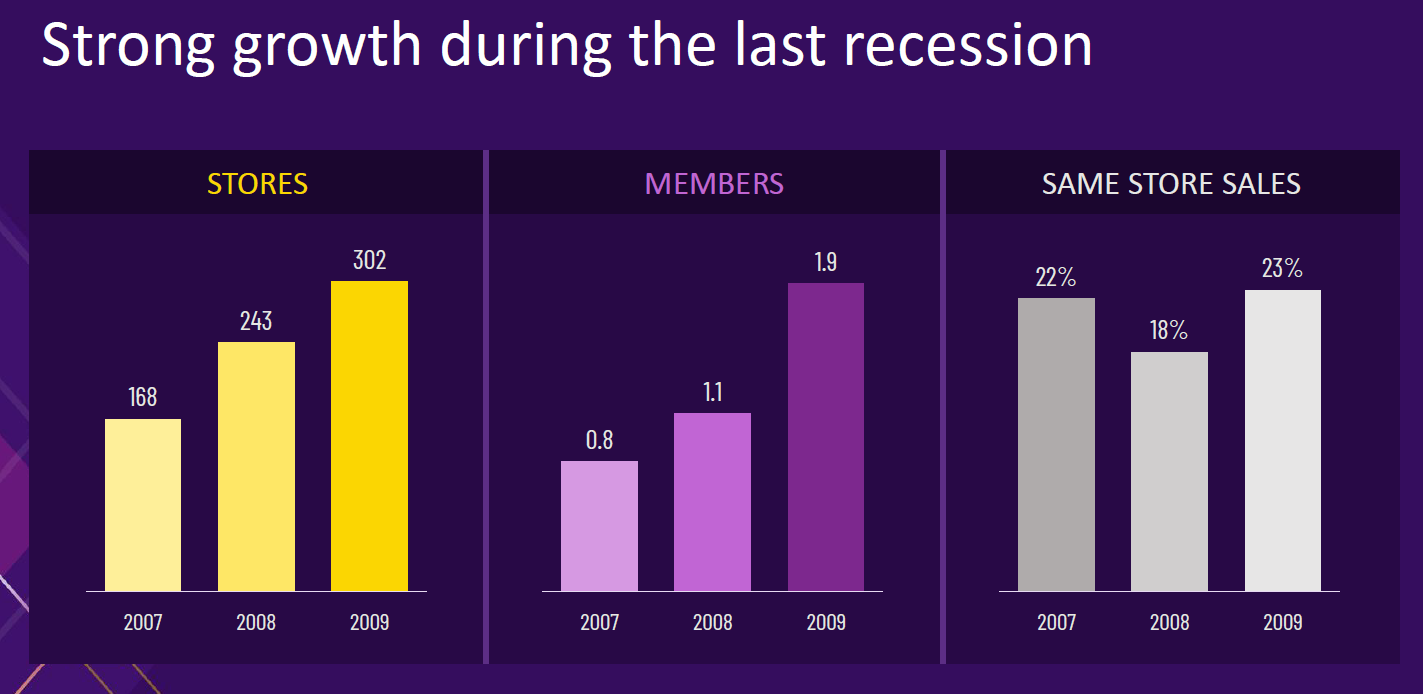

Planet Fitness has an impressive track record of growth, including during recessions. Over the last ten years, PLNT has grown revenue at +18% CAGR, with ¾ of the growth from unit (i.e. new gyms) growth, outside of the covid period, same store sales growth has also been robust at +9% p.a. average ex 2020-2021. Going forward and based on the above discussed trends, I expect the company can continue growing revenue above 8% p.a. with unit growth settling in towards 4-5% and same store sales filling out the rest. PLNT resilience was shown during the GFC with members still increasing in 2008 and 2009 and SSS of 18% and 23% respectively in 2008 and 2009.

Thanks to its asset-light model (90% of stores are franchisee), the company generates a healthy group EBITDA margin of c. 40%. As we continue to see new membership pricing and new royalty fees being adopted (as mentioned above), I expect the margin to continue to expand toward the mid forties. Assuming a 70% margin on franchised stores, 40% margin on corporate stores, and 25% for equipment would imply a 59% potential margin at the current split of 80%/20% stores/equipment revenues. Capex is limited to corporate stores and some corporate projects. As a result, FCF to EBITDA conversion has averaged 50% over the last ten years. FCF conversion has inflected down since COVID-19, including due to store closures and refurbishment during COVID-19, but I would expect it to resume expanding towards the low 60s as the post-COVID normalization ends.

Solid historical ROIC was impacted by COVID and an acquisition, but is on the mend. Pre-COVID ROIC expanded to an attractive 25%, driven by the Company's growth from 749 gyms to 2,001 between 2013 and 2019. 2020 saw the impact of Covid on earnings (EBITDA down -50%). And in 2021Planet Fitness acquired its largest franchisee, Sunshine Partners in Florida (~200 gyms), to meet its 10% target for corporate-owned locations. This acquisition, however, generated USD 500 million in goodwill, which negatively impacted the company's ROIC in 2022 and 2023. ROIC is expected to expand as Planet Fitness amortizes these acquired intangible assets, and no further large mergers and acquisitions are anticipated. The positive sign of ROIC expanding to 13% in 2024 suggests the company is progressing well and I see no reason they cannot go back to 25%+ ROIC over time.

After some challenges with the former CEO abruptly being pushed out, the new management team seems solid. Former CEO Chris Rondeau, who started as a receptionist at PLNT, was a key driver of success between 2013-2023. He was dismissed by the board at the end of 2023 due to poor internal culture and some conflict regarding pricing. It took until Summer 2024 for PLNT to find a new CEO in Colleen Keating, a former hotel and real estate executive. So far Colleen has done a good job at staying the course while implementing some changes, including choosing a new CFO following Tom Fitzgerald retirement in 2024.

The stock has done well since the management issues and the PR scandal of February 2024. Current valuation is demanding but it is a very unique business in a good neighborhood. The departure of Chris Rondeau at the end of 2023 generated significant uncertainty, compounded by the six-month search for a successor CEO and the negative PR incident in February 2024. Despite this, the stock has since recovered and currently trades at a demanding valuation. My projections indicate a robust EPS growth of at least 14% annually for the next three years, excluding any potential success in the European market. However, with the current NTM EV/EBITDA multiple at 20x, attractive total shareholder returns are contingent on the multiple staying around that level. Any compression towards the mid-teens would diminish the investment appeal. → Overall I think PLNT is a great business, defensive in the current context as a mainly US company with little tariffs exposure, visible growth from sticky revenue and good cash flow generation. It could also be a beneficiary of gym goers trading down from more expensive gyms if we see more consumer weakness. European success is also an optionality not currently priced in. The below table shows the returns I expect based on my base case (and +/- 40% variation of EBITDA) and exit EV/EBITDA NTM end of 2027. Depending on your investment horizon, I would probably wait for a better entry point here as the stock can be very sensitive to quarterly earnings.

Disclaimer: Not your financial advisor, not financial advice, do your own research, I may have positions in the names I discuss.

Find me on social media and please don’t hesitate to share feedback!

Also check the podcast on: Spotify or Apple Podcast

The Elevator Pitch — Last ten publications

Appendix 1: Planet Fitness Members profile

Appendix 2: Planet Fitness gyms locations

Appendix 3: resilience during the GFC

Hey! I saw your post pop up on my homepage and wanted to show some support. If you get a chance, I’d really appreciate a little love on my latest newsletter too always happy to boost each other!